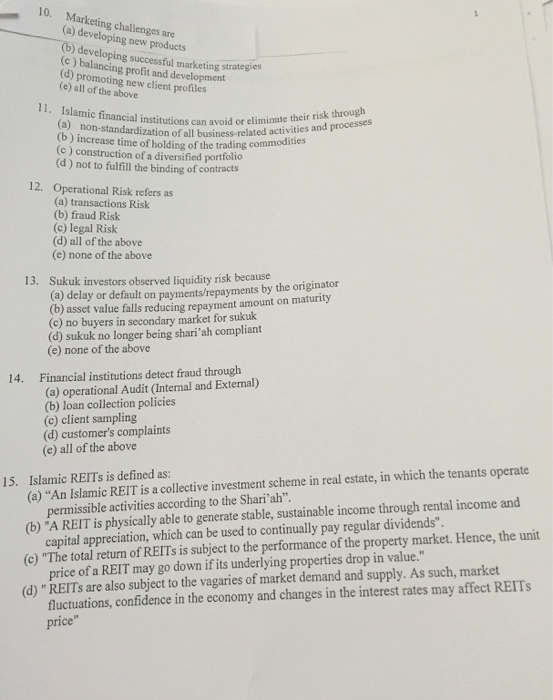

Question: 10. Marketing challenges are (a) developing new products (C) balancing profit and development (d) promoting new client profiles (e) all of the above Islamic financial

10. Marketing challenges are (a) developing new products (C) balancing profit and development (d) promoting new client profiles (e) all of the above Islamic financial institutions can avoid or elimiate tbes and processes o-tandardization of all business-related activities a (b) increase time of holding of the trading co (c) construction of a diversified portfolio (d) not to fulfill the binding of contracts 12. Operational Risk refers as (a) transactions Risk (b) fraud Risk (c) legal Risk (d) all of the above (e) none of the above Sukuk investors observed liquidity risk because (a) delay or default on payments/repayments by the originator (b) asset value falls reducing repayment amount on maturity (c) no buyers in secondary market for sukuk (d) sukuk no longer being shari'ah compliant (e) none of the above 13. 14. Financial institutions detect fraud through (a) operational Audit (Internal and Extenal) (b) loan collection policies (c) client sampling (d) customer's complaints (e) all of the above (a) "An Islamic REIT is a collective investment scheme in real estate, in which the tenants operate (b) "A REIT is physically able to generate stable, sustainable income through rental income and (c) "The total return of REITs is subject to the performance of the property market. Hence, the unit (d) "REITs are also subject to the vagaries of market demand and supply. As such, market 15. Islamic REITs is defined as: permissible activities according to the Shari'ah". capital appreciation, which can be used to continually pay regular dividends" price of a REIT may go down if its underlying properties drop in value." fluctuations, confidence in the economy and changes in the interest rates may affect REITs price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts