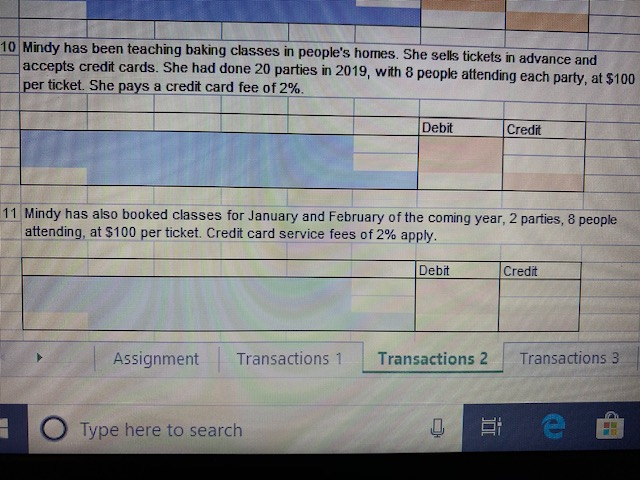

Question: 10 Mindy has been teaching baking classes in people's homes. She sells tickets in advance and accepts credit cards. She had done 20 parties in

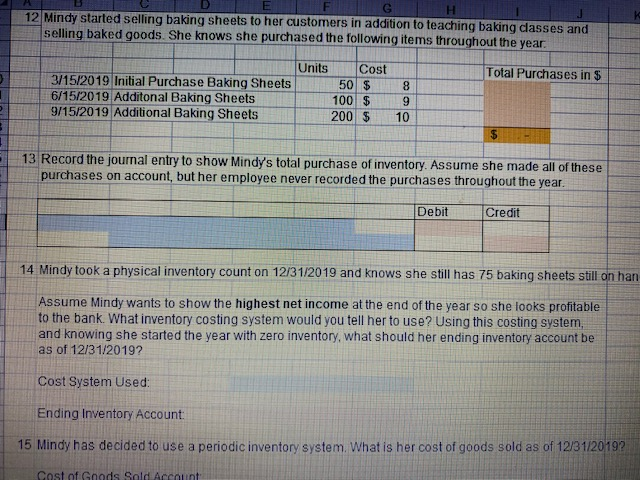

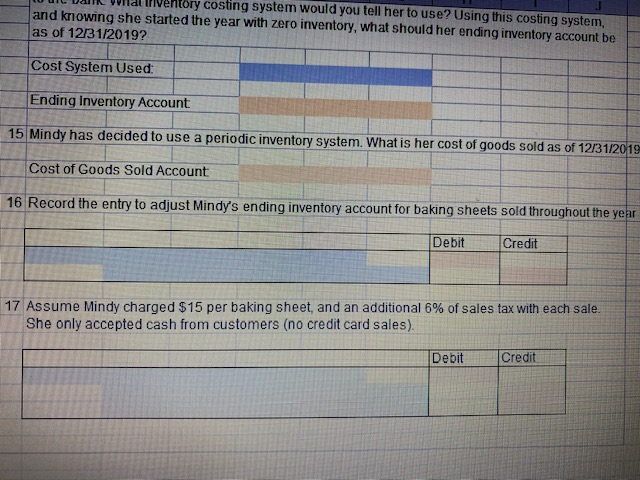

10 Mindy has been teaching baking classes in people's homes. She sells tickets in advance and accepts credit cards. She had done 20 parties in 2019, with 8 people attending each party, at $100 per ticket. She pays a credit card fee of 2%. Debit Credit 11 Mindy has also booked classes for January and February of the coming year, 2 parties, 8 people attending, at $100 per ticket. Credit card service fees of 2% apply. Debit Credit Assignment Transactions 1 Transactions 2 Transactions 3 O Type here to search & Be H 12 Mindy started selling baking sheets to her customers in addition to teaching baking dasses and selling baked goods. She knows she purchased the following items throughout the year. Total Purchases in $ Units Cost 3/15/2019 Initial Purchase Baking Sheets 50 $ 6/15/2019 Additonal Baking Sheets 100 $ 9/15/2019 Additional Baking Sheets 200 $ 8 9 10 13 Record the journal entry to show Mindy's total purchase of inventory. Assume she made all of these purchases on account, but her employee never recorded the purchases throughout the year Debit Credit 14 Mindy took a physical inventory count on 12/31/2019 and knows she still has 75 baking sheets still on han Assume Mindy wants to show the highest net income at the end of the year so she looks profitable to the bank. What inventory costing system would you tell her to use? Using this costing system, and knowing she started the year with zero inventory, what should her ending inventory account be as of 12/31/2019? Cost System Used: Ending Inventory Account: 15 Mindy has decided to use a periodic inventory system. What is her cost of goods sold as of 12/31/2019 Cotcode Qold out MORIR Y u ventory costing system would you tell her to use? Using this costing system, and knowing she started the year with zero inventory, what should her ending inventory account be as of 12/31/2019? Cost System Used: Ending Inventory Account 15 Mindy has decided to use a periodic inventory system. What is her cost of goods sold as of 12131/2019 Cost of Goods Sold Account 16 Record the entry to adjust Mindy's ending inventory account for baking sheets sold throughout the year Debit Credit 17 Assume Mindy charged $15 per baking sheet, and an additional 6% of sales tax with each sale. She only accepted cash from customers (no credit card sales). Debit Credit 10 Mindy has been teaching baking classes in people's homes. She sells tickets in advance and accepts credit cards. She had done 20 parties in 2019, with 8 people attending each party, at $100 per ticket. She pays a credit card fee of 2%. Debit Credit 11 Mindy has also booked classes for January and February of the coming year, 2 parties, 8 people attending, at $100 per ticket. Credit card service fees of 2% apply. Debit Credit Assignment Transactions 1 Transactions 2 Transactions 3 O Type here to search & Be H 12 Mindy started selling baking sheets to her customers in addition to teaching baking dasses and selling baked goods. She knows she purchased the following items throughout the year. Total Purchases in $ Units Cost 3/15/2019 Initial Purchase Baking Sheets 50 $ 6/15/2019 Additonal Baking Sheets 100 $ 9/15/2019 Additional Baking Sheets 200 $ 8 9 10 13 Record the journal entry to show Mindy's total purchase of inventory. Assume she made all of these purchases on account, but her employee never recorded the purchases throughout the year Debit Credit 14 Mindy took a physical inventory count on 12/31/2019 and knows she still has 75 baking sheets still on han Assume Mindy wants to show the highest net income at the end of the year so she looks profitable to the bank. What inventory costing system would you tell her to use? Using this costing system, and knowing she started the year with zero inventory, what should her ending inventory account be as of 12/31/2019? Cost System Used: Ending Inventory Account: 15 Mindy has decided to use a periodic inventory system. What is her cost of goods sold as of 12/31/2019 Cotcode Qold out MORIR Y u ventory costing system would you tell her to use? Using this costing system, and knowing she started the year with zero inventory, what should her ending inventory account be as of 12/31/2019? Cost System Used: Ending Inventory Account 15 Mindy has decided to use a periodic inventory system. What is her cost of goods sold as of 12131/2019 Cost of Goods Sold Account 16 Record the entry to adjust Mindy's ending inventory account for baking sheets sold throughout the year Debit Credit 17 Assume Mindy charged $15 per baking sheet, and an additional 6% of sales tax with each sale. She only accepted cash from customers (no credit card sales). Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts