Question: (10) Ms. Client opened her first bicycle shop (Schedule C) on August 1, 2019. Here is the complete list of expenditures she made earlier during

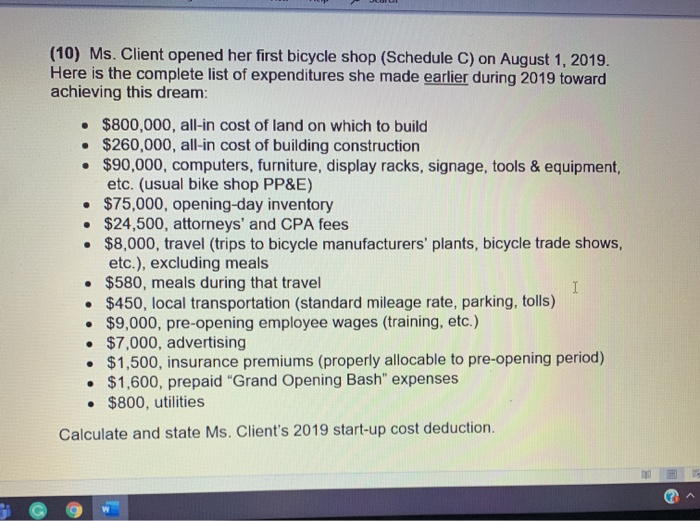

(10) Ms. Client opened her first bicycle shop (Schedule C) on August 1, 2019. Here is the complete list of expenditures she made earlier during 2019 toward achieving this dream: $800,000, all-in cost of land on which to build $260,000, all-in cost of building construction $90,000, computers, furniture, display racks, signage, tools & equipment, etc. (usual bike shop PP&E) $75,000, opening day inventory $24,500, attorneys' and CPA fees $8,000, travel (trips to bicycle manufacturers' plants, bicycle trade shows, etc.), excluding meals $580, meals during that travel $450, local transportation (standard mileage rate, parking, tolls) $9,000, pre-opening employee wages (training, etc.) $7,000, advertising $1,500, insurance premiums (properly allocable to pre-opening period) $1,600, prepaid "Grand Opening Bash" expenses $800, utilities Calculate and state Ms. Client's 2019 start-up cost deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts