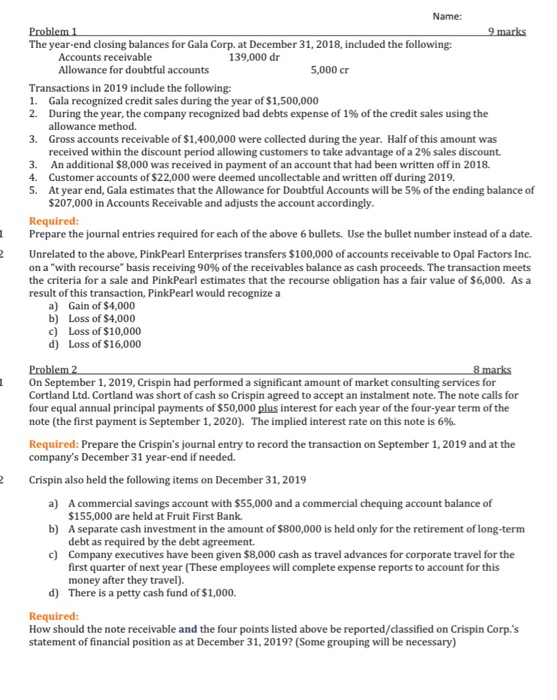

Question: 10 Name: Problem 1 9 marks The year-end closing balances for Gala Corp. at December 31, 2018, included the following: Accounts receivable 139,000 dr Allowance

10 Name: Problem 1 9 marks The year-end closing balances for Gala Corp. at December 31, 2018, included the following: Accounts receivable 139,000 dr Allowance for doubtful accounts 5,000 cr Transactions in 2019 include the following: 1. Gala recognized credit sales during the year of $1,500,000 2. During the year, the company recognized bad debts expense of 1% of the credit sales using the allowance method. 3. Gross accounts receivable of $1,400,000 were collected during the year. Half of this amount was received within the discount period allowing customers to take advantage of a 2% sales discount. 3. An additional $8,000 was received in payment of an account that had been written off in 2018. 4. Customer accounts of $22,000 were deemed uncollectable and written off during 2019. 5. At year end, Gala estimates that the Allowance for Doubtful Accounts will be 5% of the ending balance of $207,000 in Accounts Receivable and adjusts the account accordingly. Required: Prepare the journal entries required for each of the above 6 bullets. Use the bullet number instead of a date. Unrelated to the above, PinkPearl Enterprises transfers $100,000 of accounts receivable to Opal Factors Inc. on a "with recourse" basis receiving 90% of the receivables balance as cash proceeds. The transaction meets the criteria for a sale and PinkPearl estimates that the recourse obligation has a fair value of $6,000. As a result of this transaction, PinkPearl would recognize a a) Gain of $4,000 b) Loss of $4,000 c) Loss of $10,000 d) Loss of $16,000 Problem 2 8 marks On September 1, 2019, Crispin had performed a significant amount of market consulting services for Cortland Ltd. Cortland was short of cash so Crispin agreed to accept an instalment note. The note calls for four equal annual principal payments of $50,000 plus interest for each year of the four-year term of the note (the first payment is September 1, 2020). The implied interest rate on this note is 6%. Required: Prepare the Crispin's journal entry to record the transaction on September 1, 2019 and at the company's December 31 year-end if needed. Crispin also held the following items on December 31, 2019 a) A commercial savings account with $55,000 and a commercial chequing account balance of $155,000 are held at Fruit First Bank b) A separate cash investment in the amount of $800,000 is held only for the retirement of long-term debt as required by the debt agreement. c) Company executives have been given $8,000 cash as travel advances for corporate travel for the first quarter of next year (These employees will complete expense reports to account for this money after they travel). d) There is a petty cash fund of $1,000. Required: How should the note receivable and the four points listed above be reported/classified on Crispin Corp.'s statement of financial position as at December 31, 2019? (Some grouping will be necessary) 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts