Question: (10 points) 3) A) An investor is considering adding an additional stock to his portfolio.It is a multi- asset portfolio. The investor is a rational,

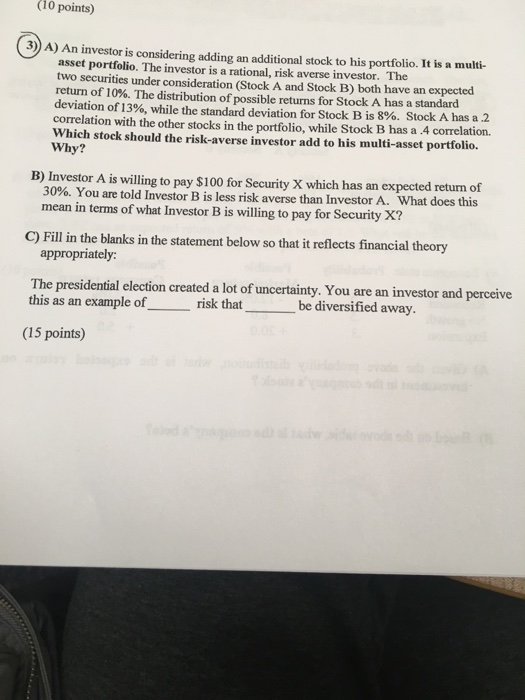

(10 points) 3) A) An investor is considering adding an additional stock to his portfolio.It is a multi- asset portfolio. The investor is a rational, risk averse investor. The two securities under consideration (Stock A and Stock B) both have an expected return of 10%. The distribution of possible returns for Stock A has a standard deviation of 13%, while the standard deviation for Stock B is 80%. Stock A has a 2 correlation with the other stocks in the portfolio, while Stock B has a 4 correlation. Which stock should the risk-averse investor add to his multi-asset portfolio. Why? B) Investor A is willing to pay $100 for Security X which has an expected return of 30%. You are told Investor B is less risk averse than Investor A. What does this mean in terms of what Investor B is willing to pay for Security X? C) Fill in the blanks in the statement below so that it reflects financial theory appropriately: The presidential election created a lot of uncertainty. You are an investor and perceive this as an example of be diversified away. rrisk that (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts