Question: (10 points) On a typical day, ABC company writes checks totaling $3,000. These checks clear in 7 days. Simultaneously, the company receives $1,700. The cash

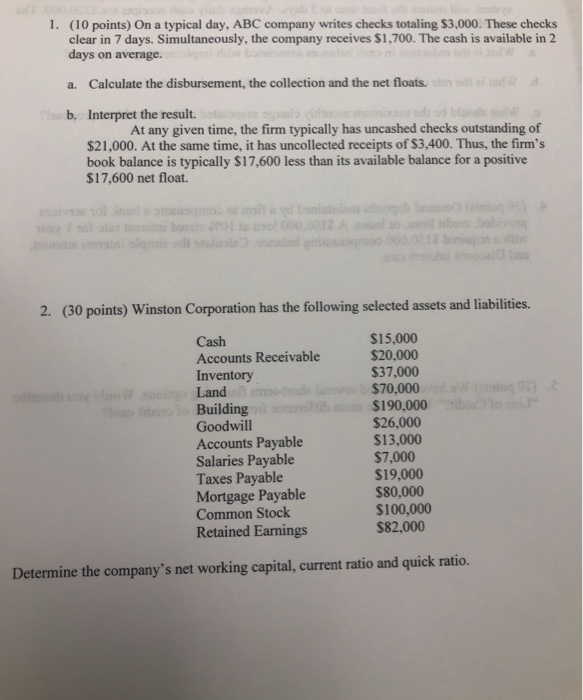

(10 points) On a typical day, ABC company writes checks totaling $3,000. These checks clear in 7 days. Simultaneously, the company receives $1,700. The cash is available in 2 days on average. 1. a. Calculate the disbursement, the collection and the net floats b. Interpret the result. At any given time, the firm typically has uncashed checks outstanding of $21,000. At the same time, it has uncollected receipts of $3,400. Thus, the firm's book balance is typically $17,600 less than its available balance for a positive $17,600 net float. 2. (30 points) Winston Corporation has the following selected assets and liabilities. Cash Accounts Receivable Inventory Land Building Goodwill Accounts Payable Salaries Payable Taxes Payable Mortgage Payable Common Stock Retained Earnings $15,000 $20,000 $37,000 $70,000 $190,000 $26,000 $13,000 $7,000 $19,000 $80,000 $100,000 $82,000 Determine the company's net working capital, current ratio and quick ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts