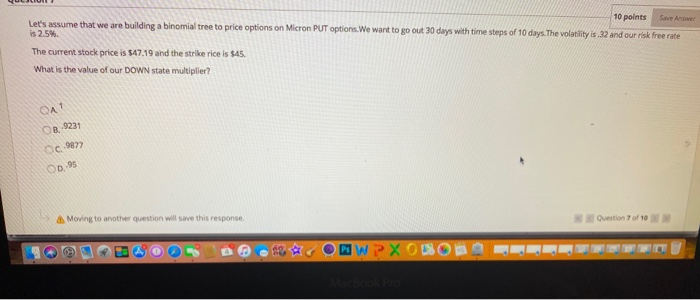

Question: 10 points Save Aner Let's assume that we are building a binomial tree to price options on Micron PUT options. We want to go out

10 points Save Aner Let's assume that we are building a binomial tree to price options on Micron PUT options. We want to go out 30 days with time steps of 10 days. The volatility is 32 and our risk free rate is 2.5%. The current stock price is 547.19 and the strike rice is $45. What is the value of our DOWN state multiplier? B. 9231 OC.072 Moving to another question will save this response Question 7 of 10 10 points Save Aner Let's assume that we are building a binomial tree to price options on Micron PUT options. We want to go out 30 days with time steps of 10 days. The volatility is 32 and our risk free rate is 2.5%. The current stock price is 547.19 and the strike rice is $45. What is the value of our DOWN state multiplier? B. 9231 OC.072 Moving to another question will save this response Question 7 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts