Question: 10 points Save Answer Adam Smith is a portfolio Manager with Point72 Investments, a U.S.-based asset management firm. Smith is considering using options to enhance

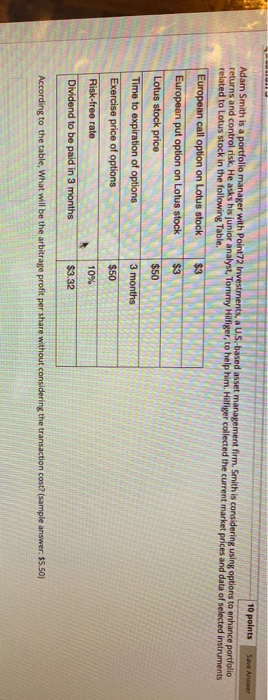

10 points Save Answer Adam Smith is a portfolio Manager with Point72 Investments, a U.S.-based asset management firm. Smith is considering using options to enhance portfolio returns and control risk. He asks his junior analyst, Tommy Hilfiger, to help him. Hilfiger collected the current market prices and data of selected instruments related to Lotus stock in the following Table. AL European call option on Lotus stock $3 European put option on Lotus stock $3 W Lotus stock price $50 Time to expiration of options 3 months Exercise price of options $50 Risk-free rate Dividend to be paid in 3 months $3.32 According to the table, What will be the arbitrage profit per share without considering the transaction cost? (sample answer: $5.50)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts