Question: 10 points Save Answer Apple Computer Inc. of U.S. has purchased a Japanese company which produces computer chips. The purchase price is 400 million with

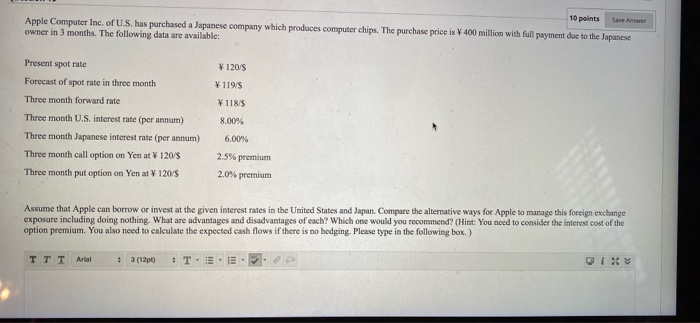

10 points Save Answer Apple Computer Inc. of U.S. has purchased a Japanese company which produces computer chips. The purchase price is 400 million with full payment due to the Japanese owner in 3 months. The following data are available: 120/5 119/8 Present spot rate Forecast of spot rate in three month Three month forward rate Three month U.S. interest rate (per annum) Three month Japanese interest rate (per annum) Three month call option on Yen at 120/5 Three month put option on Yen at 120/5 118/ 8.00% 6.00% 2.5% premium 2.0% premium Assume that Apple can borrow or invest at the given interest rates in the United States and Japan. Compare the alternative ways for Apple to manage this foreign exchange exposure including doing nothing. What are advantages and disadvantages of each? Which one would you recommend? (Hint: You need to consider the interest cost of the option premium. You also need to calculate the expected cash flows if there is no hedging, Please type in the following box.) TTT Arial 3(12pt) T.E.E. 225 Rix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts