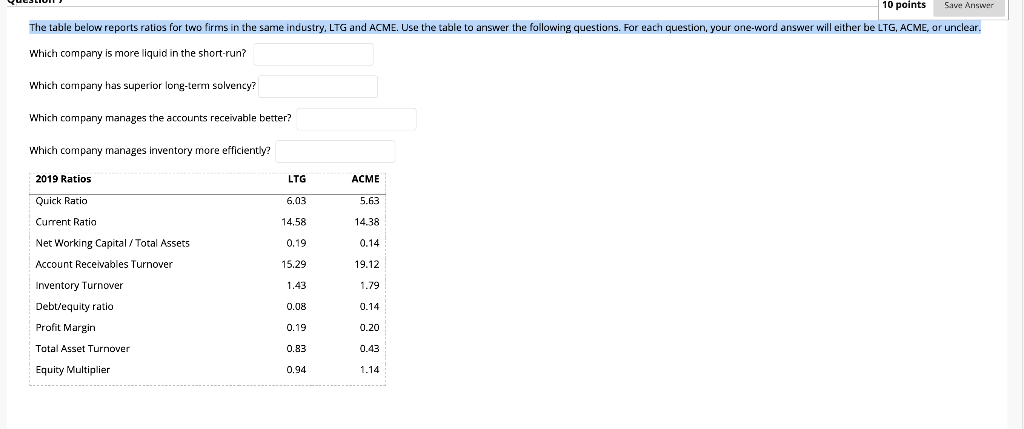

Question: 10 points Save Answer The table below reports ratios for two firms in the same industry, LTG and ACME. Use the table to answer the

10 points Save Answer The table below reports ratios for two firms in the same industry, LTG and ACME. Use the table to answer the following questions. For each question, your one-word answer will either be LTG, ACME, or unclear. Which company is more liquid in the short-run? Which company has superior long-term solvency? Which company manages the accounts receivable better? which company manages inventory more efficiently? 2019 Ratios LTG ACME Quick Ratio 6.03 5.63 14.58 14.38 0.19 0.14 15.29 19.12 1.43 1.79 Current Ratio Net Working Capital / Total Assets Account Receivables Turnover Inventory Turnover Debt/equity ratio Profit Margin Total Asset Turnover Equity Multiplier 0.08 0.19 0.20 0.43 0.83 0.94 1.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts