Question: 10 points Save Answer You just bought the stock A at $ 50 and you have been given the following data about the expected values

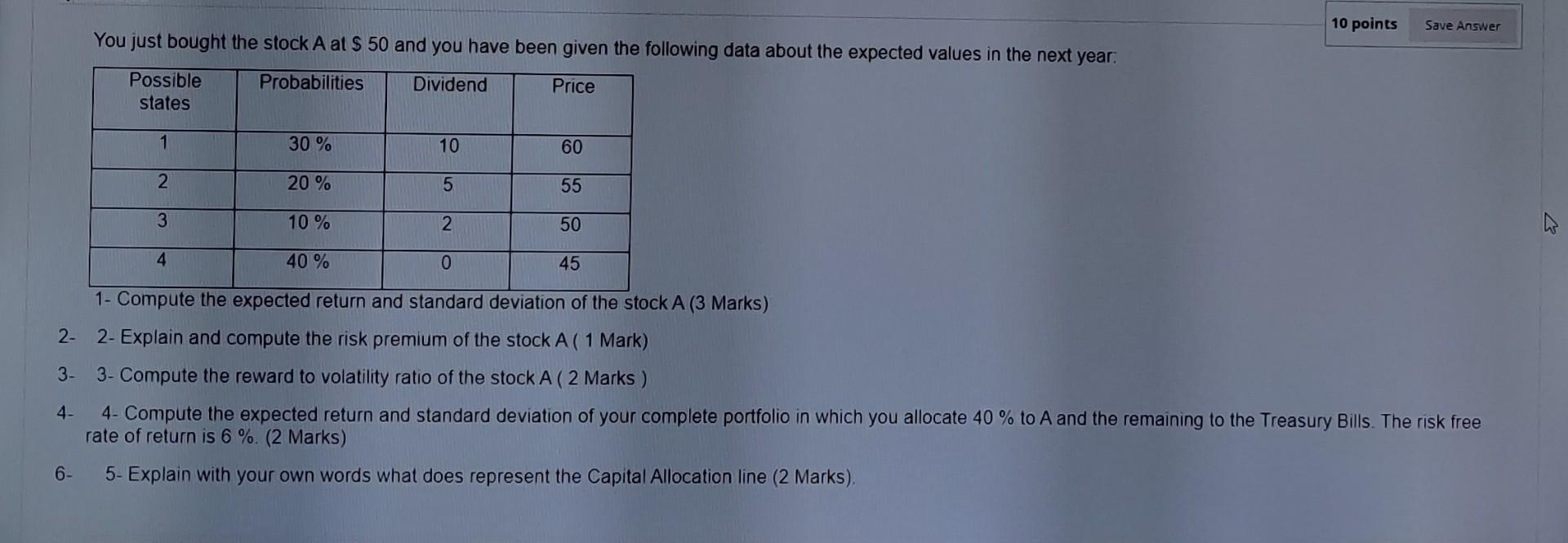

10 points Save Answer You just bought the stock A at $ 50 and you have been given the following data about the expected values in the next year. Possible states Probabilities Dividend Price 1 30 % 10 60 2 20% 5 55 3 10% 2 50 4 40 % 0 45 2- 3- 1- Compute the expected return and standard deviation of the stock A (3 Marks) 2- Explain and compute the risk premium of the stock A ( 1 Mark) 3- Compute the reward to volatility ratio of the stock A ( 2 Marks ) 4- Compute the expected return and standard deviation of your complete portfolio in which you allocate 40% to A and the remaining to the Treasury Bills. The risk free rate of return is 6 %. (2 Marks) 4- 6- 5- Explain with your own words what does represent the Capital Allocation line (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts