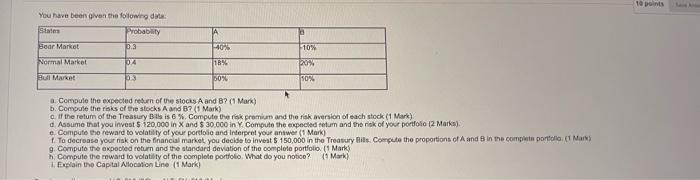

Question: 10 points You have been given the following data Probably A 1 Sear Market pa 10% 10% Normal Market 04 18% 09 20% 50% BI

10 points You have been given the following data Probably A 1 Sear Market pa 10% 10% Normal Market 04 18% 09 20% 50% BI Market 3 a. Compute the expected return of the stocks A and B? (Mark) b. Compute the risks of the stocks A and B? (Mark) c. If the return of the Treasury Bis is 6 % Compute the risk premium and the risk version of each stock (1 Mark) d. Assume that you invest $ 120,000 in X and $ 30.000 in Y Compute the expected totum and the risk of your portfolio 2 Marka) e. Compute the reward to volatility of your portfolio and Interpret your answer Mark) 1. To decrease your risk on the financial market you decide to invest $ 150,000 in the Treasury Bits Compute the proportions of A and B in the complete portfolio C1 Mars g. Computo the expected return and the standard deviation of the complete portfolio (1 Mark Compute the reward to volatility of the complete portfolio What do you notice? Mark) 1. Explain the Capital Allocation Line (1 Mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts