Question: (10 points) Your company is considering a machine which will cost $100,000 at Time 0 and which can be sold after years for $200,000. $240,000

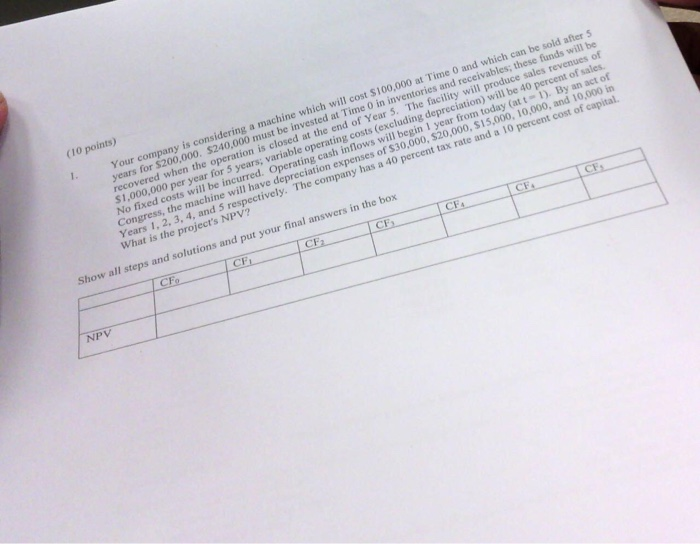

(10 points) Your company is considering a machine which will cost $100,000 at Time 0 and which can be sold after years for $200,000. $240,000 must be invested at Time 0 in inventories and receivables; these funds will be recovered when the operation is closed at the end of Year 5. The facility will produce sales revenues of $1,000,000 per year for 5 years; variable operating costs (excluding depreciation) will be 40 percent of sales No fixed costs will be incurred. Operating cash inflows will begin 1 year from today (att 1). By an act of Congress, the machine will have depreciation expenses of $30,000, $20,000, $15,000, 10,000, and 10,000 in Years 1, 2, 3, 4, and 5 respectively. The company has a 40 percent tax rate and a 10 percent cost of capital. What is the project's NPV? Show all steps and solutions and put your final answers in the box CE Fy CF NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts