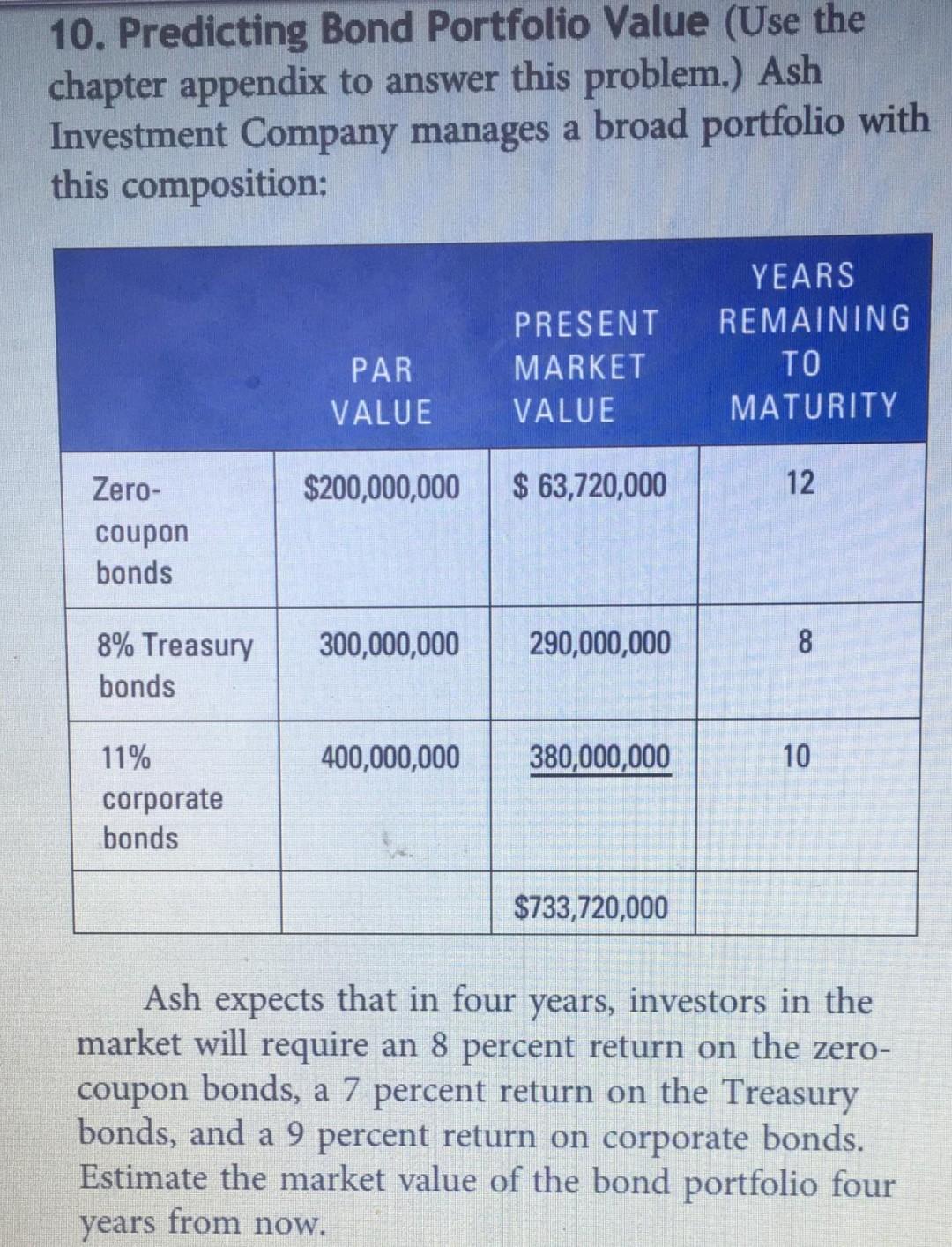

Question: 10. Predicting Bond Portfolio Value (Use the chapter appendix to answer this problem.) Ash Investment Company manages a broad portfolio with this composition: YEARS REMAINING

10. Predicting Bond Portfolio Value (Use the chapter appendix to answer this problem.) Ash Investment Company manages a broad portfolio with this composition: YEARS REMAINING PRESENT PAR MARKET MATURITY VALUE VALUE Zero- $200,000,000 $63,720,000 12 coupon bonds 8% Treasury 300,000,000 290,000,000 8 bonds 11% 400,000,000 380,000,000 10 corporate bonds $733,720,000 Ash expects that in four years, investors in the market will require an 8 percent return on the zero- coupon bonds, a 7 percent return on the Treasury bonds, and a 9 percent return on corporate bonds. Estimate the market value of the bond portfolio four years from now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts