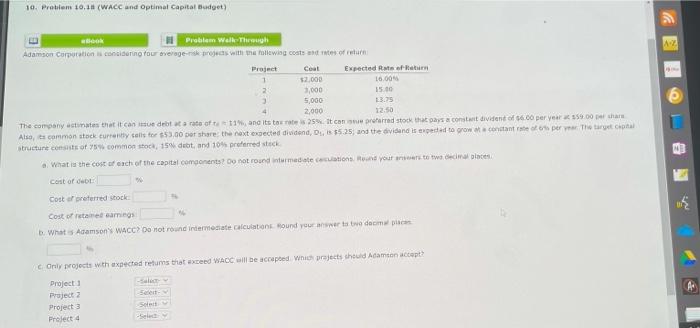

Question: 10. Problem 10.1 (WACC and Optimal Capital Budget) Problem Walk Through Adamson Corporation is considerino fou everages with the following costs and res of return

10. Problem 10.1 (WACC and Optimal Capital Budget) Problem Walk Through Adamson Corporation is considerino fou everages with the following costs and res of return Project Coat Expected to 1 $2.000 16.00 2 3,000 15.00 5,000 2.000 12.50 The company states that it can su debt to rate of tot and its toute 25. It can read stock that pays a constant dividend of 6.00 per year 15900 har Also, a common stock currently calls for $55,00 por share the next expected dicend, DL, $5.25, and the dividend is spedd to grow contante per the target cota structure consists of common stock, 15 debt and 10% preferred stock What is the cost of arch of the capital components? Do not round Intermediate actions on your own places cost of Cost of referred stock Cost of ritet samings b. What Adamson's WACC Hot round Intermediate calculation round your awet te dem 03 Only projects with expected retums that exceed WACC will be accepted which prajects should Adamson accept? Project Project 2 Project Project 4 Set -Sel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts