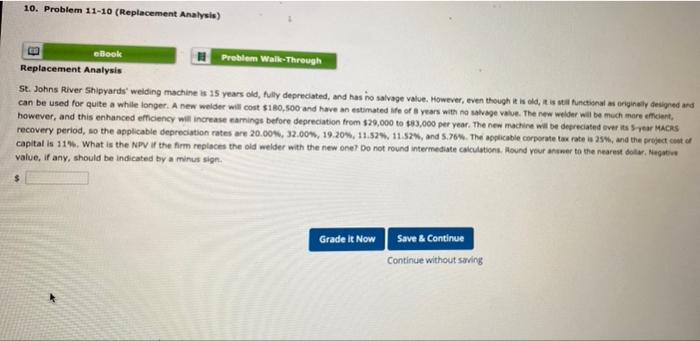

Question: 10. Problem 11-10 (Replacement Analysis) eBook Problem Walle-Through Replacement Analysis St. Johns River Shipyards' welding machine is 15 years old, My deprecated, and has no

10. Problem 11-10 (Replacement Analysis) eBook Problem Walle-Through Replacement Analysis St. Johns River Shipyards' welding machine is 15 years old, My deprecated, and has no salvage value. However, even though its old, it is still unctions originally designed and can be used for quite a while longer. A new welder will cost $180,500 and have an estimated We of years with no salvage value. The new welder will be much more than however, and this enhanced efficiency will increase samnings before depreciation from $20,000 to $83,000 per year. The new machine will be depreciated over its Ser MACRS recovery period, so the applicable depreciation rates are 20.001, 32,007, 19,20%, 11.529, 11.52%, and 5. 76. The applicable corporate tax rate 25%, and the project costo capital is 114. What is the NPV it the firm replaces the old weider with the new one? Do not round intermediate calculations. Hound your newer to the nearest dotarMeget value, if any, should be indicated by a minus sign Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts