Question: 10 Problem 19-4A Overhead allocation and adjustment using e predetermined overhead rate LO P3, P4 In December 2016, Learer Company's manager estimated next year's total

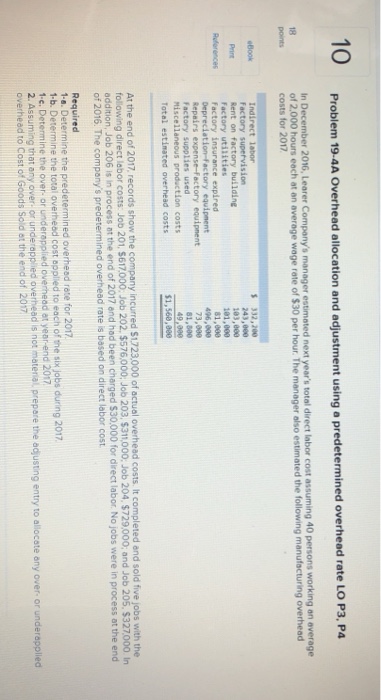

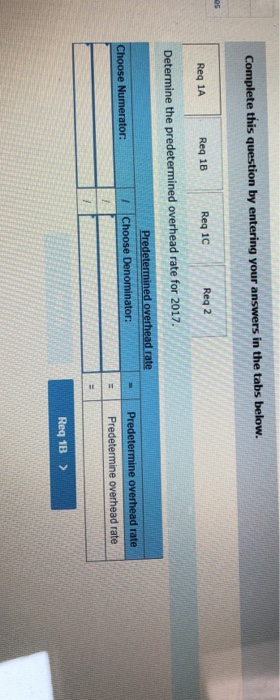

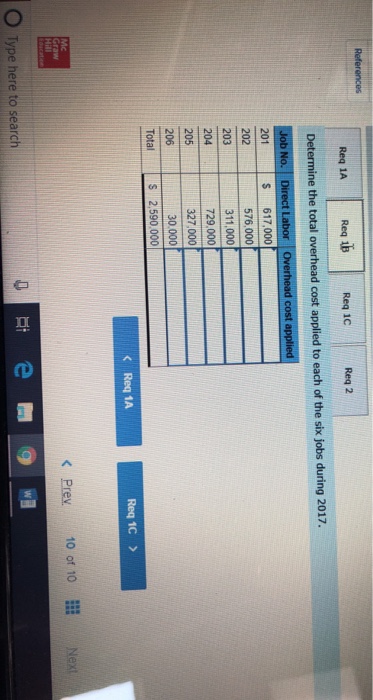

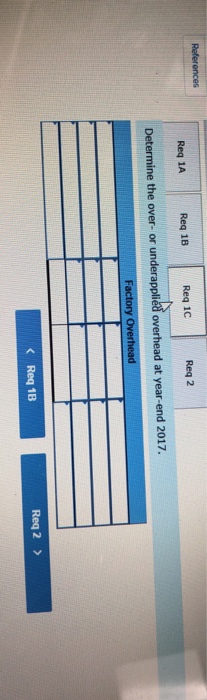

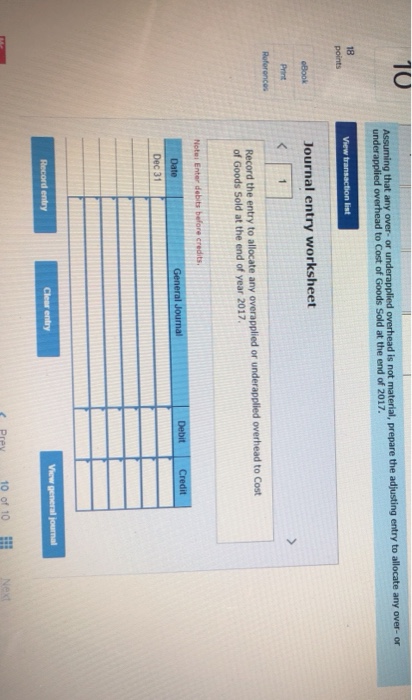

10 Problem 19-4A Overhead allocation and adjustment using e predetermined overhead rate LO P3, P4 In December 2016, Learer Company's manager estimated next year's total direct labor cost assuming 40 persons working an everage 18 points of 2.000 hours each at an average wage rate of $30 per hour. The manager also estimated the following manufacturing overhead costs for 2017 Factory supetvision Rent on factory builaing Factory utilities Factory insurance expired Depreciation-Factory equipment 243,000 183,800 101,009 81,000 496,000 73,000 81,880 49,000 actory equipnent Factory supplies used Miscellaneous production costs Total estinated overhead costs Ar the end of 2017, records show the company incurred $1723000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs Job 201, $617000. Job 202, $576,000, Job 203, $311,000, Job 204. $729,000, and Job 205, $327000 In addition, Job 206 is in process at the end of 2017 and had been charged $30,000 for direct labor. No jobs were in process at the end of 2016. The company's predetermined overhead rate is based on direct labor cost Required 1-a. Determine the predetermined overhead rate for 2017 1-b. Determine the total overhead cost applied to each of the six jobs during 2017 1-c. Determine the over-or underapplied overhead et year-end 2017 2. Assuming that any over or underapplied overhead is not material prepare the adjusting entry to allocate any over or underapplied overhead to Cost of Goods Sold at the end of 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts