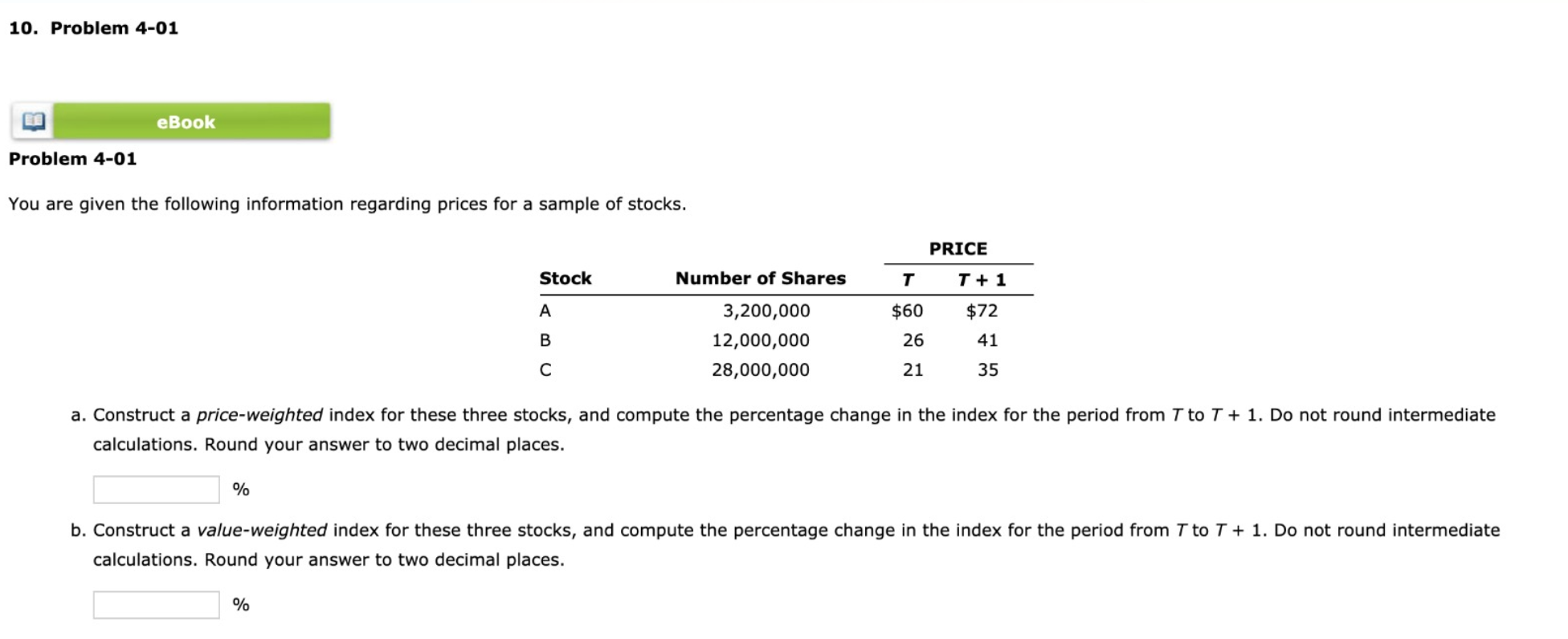

Question: 10. Problem 4-01 eBook Problem 4-01 You are given the following information regarding prices for a sample of stocks. PRICE Stock Number of Shares T

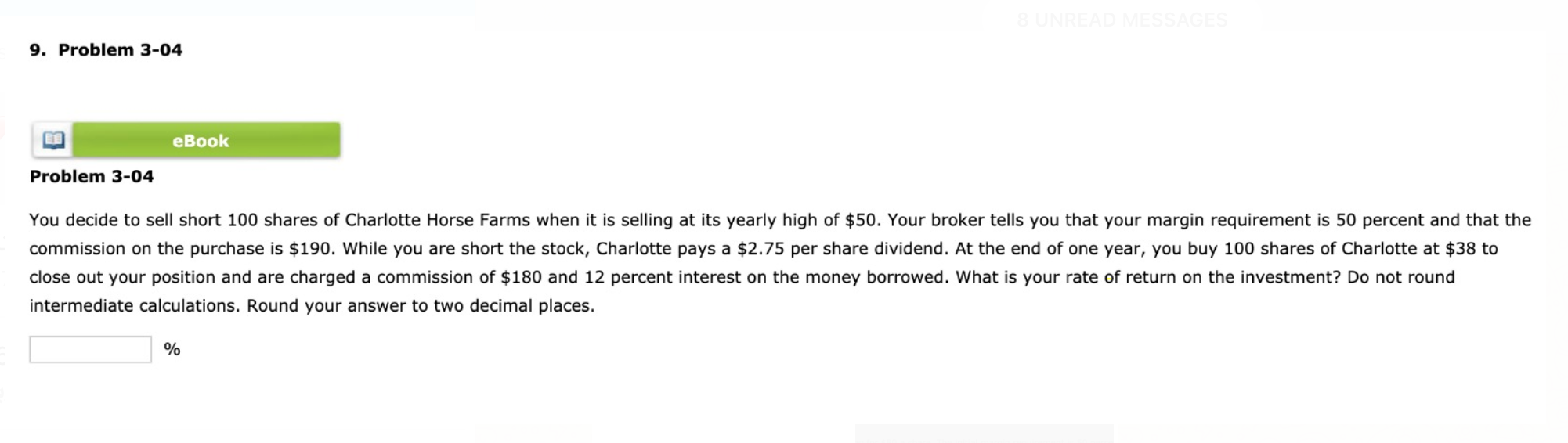

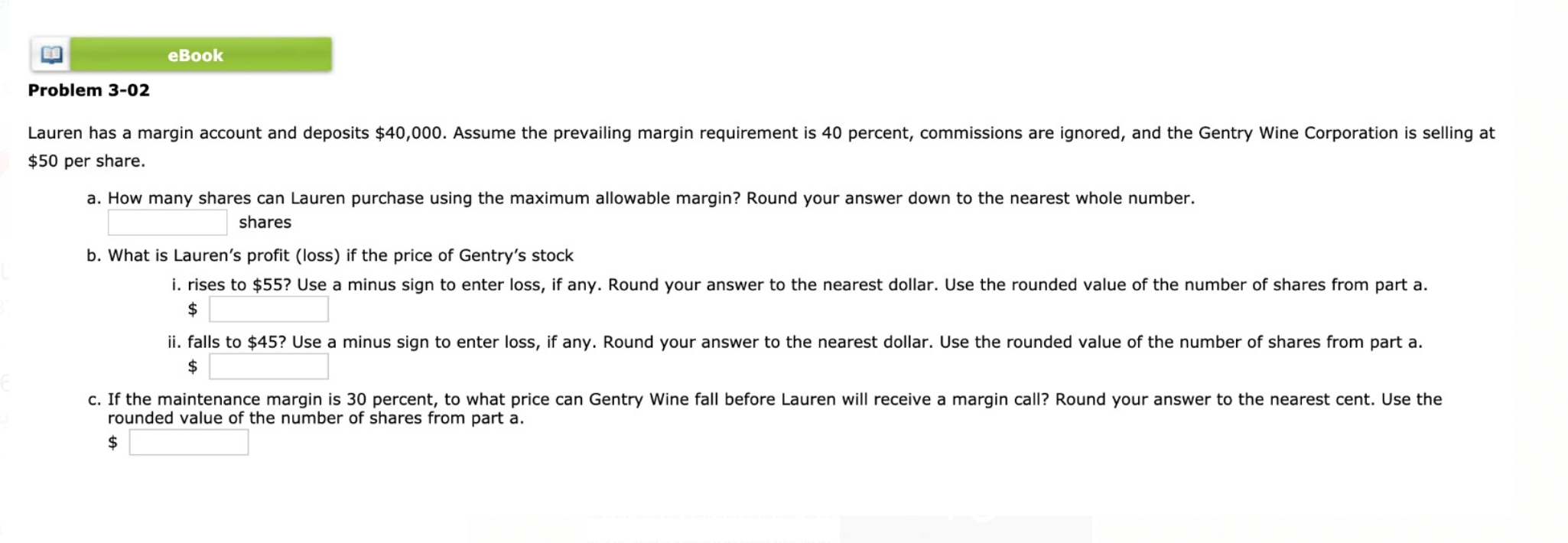

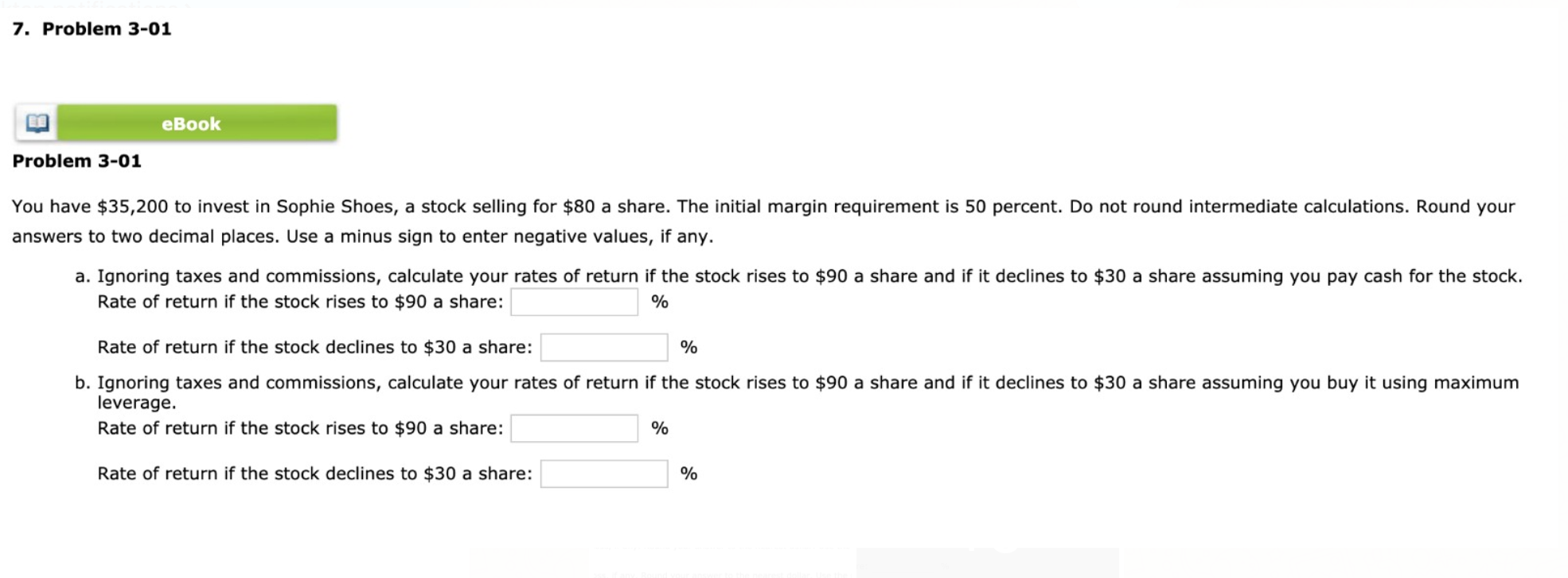

10. Problem 4-01 eBook Problem 4-01 You are given the following information regarding prices for a sample of stocks. PRICE Stock Number of Shares T T + 1 A $60 $72 B 3,200,000 12,000,000 28,000,000 26 41 C 21 35 a. Construct a price-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. Do not round intermediate calculations. Round your answer to two decimal places. % b. Construct a value-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. Do not round intermediate calculations. Round your answer to two decimal places. % 8 UNREAD MESSAGES 9. Problem 3-04 eBook Problem 3-04 You decide to sell short 100 shares of Charlotte Horse Farms when it is selling at its yearly high of $50. Your broker tells you that your margin requirement is 50 percent and that the commission on the purchase is $190. While you are short the stock, Charlotte pays a $2.75 per share dividend. At the end of one year, you buy 100 shares of Charlotte at $38 to close out your position and are charged a commission of $180 and 12 percent interest on the money borrowed. What is your rate of return on the investment? Do not round intermediate calculations. Round your answer to two decimal places. % eBook Problem 3-02 Lauren has a margin account and deposits $40,000. Assume the prevailing margin requirement is 40 percent, commissions are ignored, and the Gentry Wine Corporation is selling at $50 per share. a. How many shares can Lauren purchase using the maximum allowable margin? Round your answer down to the nearest whole number. shares b. What is Lauren's profit (loss) if the price of Gentry's stock i. rises to $55? Use a minus sign to enter loss, if any. Round your answer to the nearest dollar. Use the rounded value of the number of shares from part a. $ ii. falls to $45? Use a minus sign to enter loss, if any. Round your answer to the nearest dollar. Use the rounded value of the number of shares from part a. $ c. If the maintenance margin is 30 percent, to what price can Gentry Wine fall before Lauren will receive a margin call? Round your answer to the nearest cent. Use the rounded value of the number of shares from part a. $ 7. Problem 3-01 eBook Problem 3-01 You have $35,200 to invest in Sophie Shoes, a stock selling for $80 a share. The initial margin requirement is 50 percent. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. a. Ignoring taxes and commissions, calculate your rates of return if the stock rises to $90 a share and if it declines to $30 a share assuming you pay cash for the stock. Rate of return if the stock rises to $90 a share: % Rate of return if the stock declines to $30 a share: % b. Ignoring taxes and commissions, calculate your rates of return if the stock rises to $90 a share and if it declines to $30 a share assuming you buy it using maximum leverage. Rate of return if the stock rises to $90 a share: % Rate of return if the stock declines to $30 a share: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts