Question: 10. Problem 4-06 (Future Value: Ordinary Annuity versus Annuity Due) Future Value: Ordinary Annuity versus Annuity Due What is the future value of a 7%,5-year

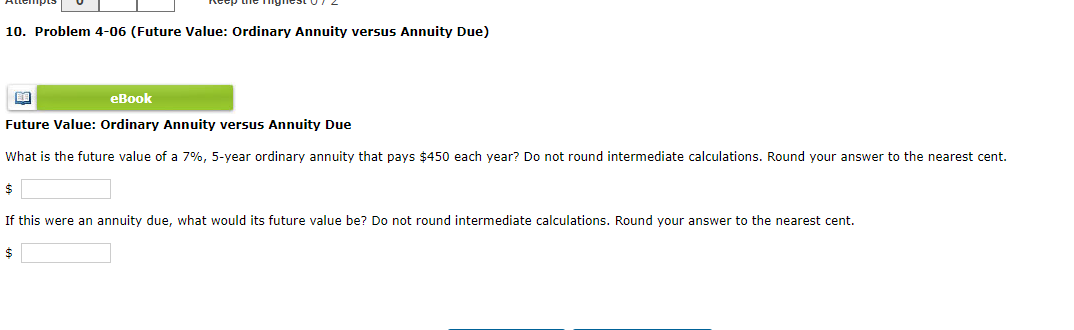

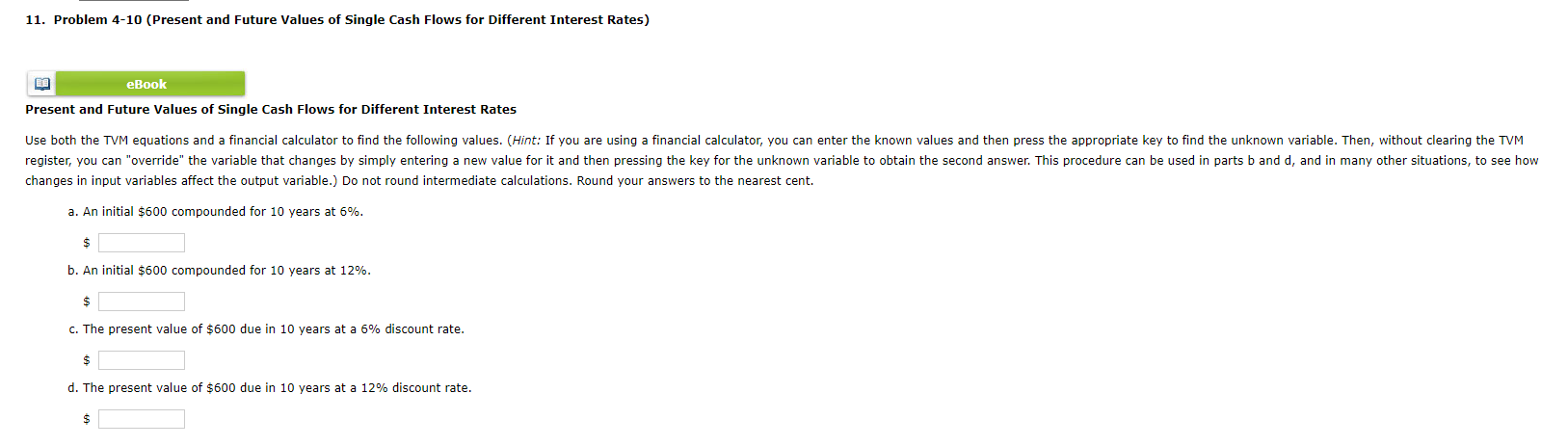

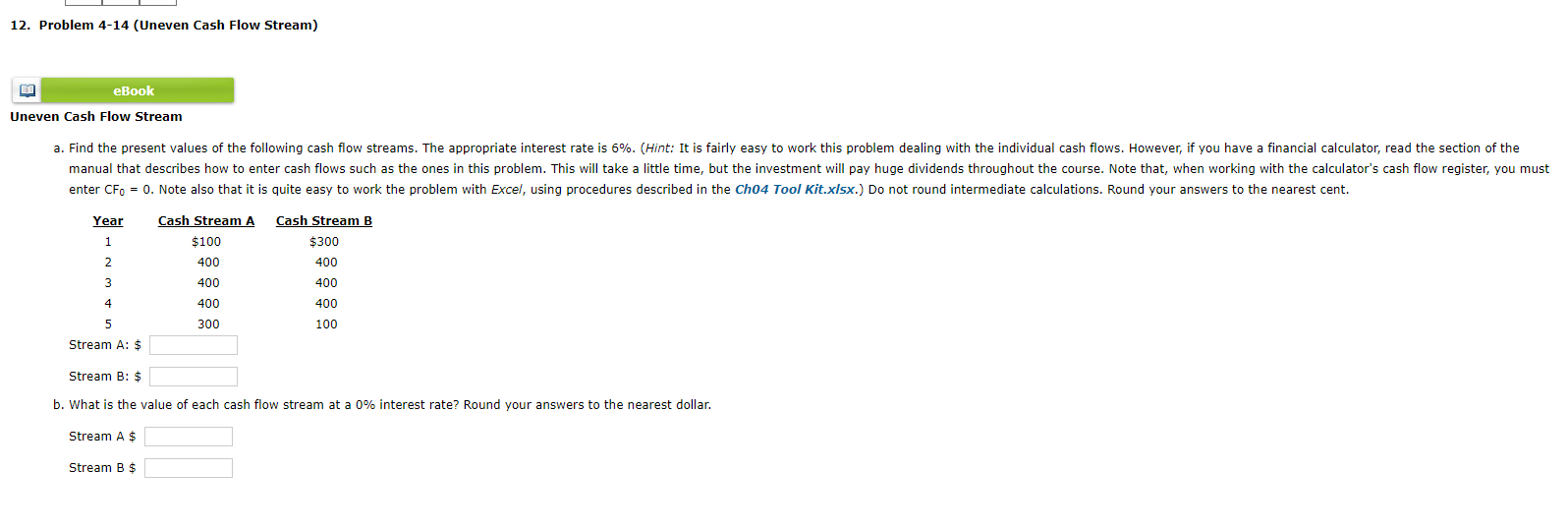

10. Problem 4-06 (Future Value: Ordinary Annuity versus Annuity Due) Future Value: Ordinary Annuity versus Annuity Due What is the future value of a 7%,5-year ordinary annuity that pays $450 each year? Do not round intermediate calculations. Round your answer to the nearest cent. $ If this were an annuity due, what would its future value be? Do not round intermediate calculations. Round your answer to the nearest cent. $ 11. Problem 4-10 (Present and Future Values of Single Cash Flows for Different Interest Rates) Present and Future Values of Single Cash Flows for Different Interest Rates changes in input variables affect the output variable.) Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $600 compounded for 10 years at 6%. $ b. An initial $600 compounded for 10 years at 12%. $ c. The present value of $600 due in 10 years at a 6% discount rate. $ d. The present value of $600 due in 10 years at a 12% discount rate. $ 12. Problem 4-14 (Uneven Cash Flow Stream) Uneven Cash Flow Stream stream A: $ Stream B: $ b. What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream A \$ Stream B \$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts