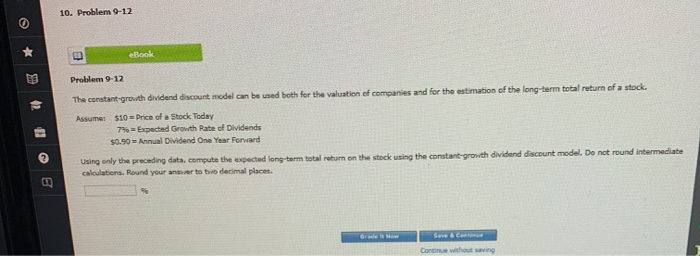

Question: 10. Problem 9-12 eBook Problem 9-12 The constant-growth dividend discount model can be used both for the valuation of companies and for the estimation of

10. Problem 9-12 eBook Problem 9-12 The constant-growth dividend discount model can be used both for the valuation of companies and for the estimation of the long-term total return of a stock. Assumet S10 = Price of a Stock Today 7% = Expected Growth Rate of Dividends $0.90 Annual Dividend One Year Forward Using only the preceding data, compute the expected long-term total return on the stock using the constant growth dividend discount model. Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock