Question: (10 pts). (Present Worth). How much do you have to invest today in a 6% Certificate of Deposit with a three-year term to receive $10,000

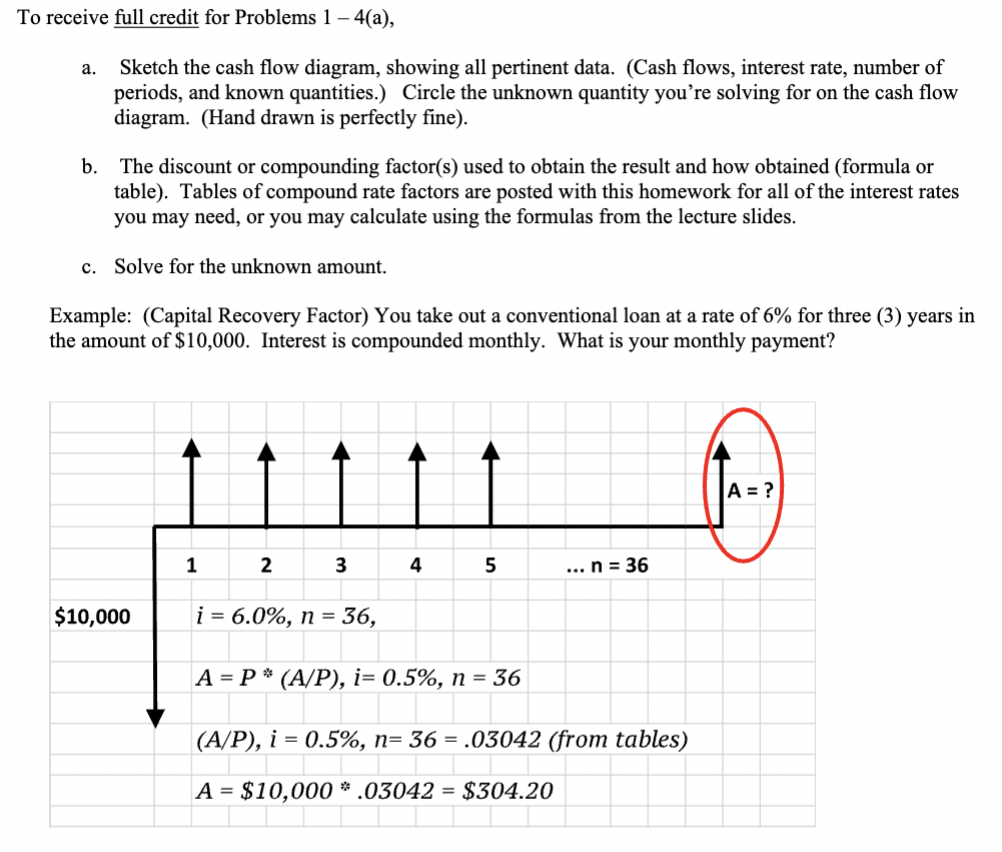

(10 pts). (Present Worth). How much do you have to invest today in a 6\% Certificate of Deposit with a three-year term to receive $10,000 at the end of three years? Interest is compounded annually. (Bonus +3 pts). Show how the results from Problem 1 could be used to calculate the Present Worth Factor for Problem 2. o receive full credit for Problems 14(a), a. Sketch the cash flow diagram, showing all pertinent data. (Cash flows, interest rate, number of periods, and known quantities.) Circle the unknown quantity you're solving for on the cash flow diagram. (Hand drawn is perfectly fine). b. The discount or compounding factor(s) used to obtain the result and how obtained (formula or table). Tables of compound rate factors are posted with this homework for all of the interest rates you may need, or you may calculate using the formulas from the lecture slides. c. Solve for the unknown amount. Example: (Capital Recovery Factor) You take out a conventional loan at a rate of 6% for three (3) years in the amount of $10,000. Interest is compounded monthly. What is your monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts