Question: 10 pts Question 16 MINNOW has a project under consideration that would cost $200M (M = million). Among the required equipment, MINNOW needs electric shovels.

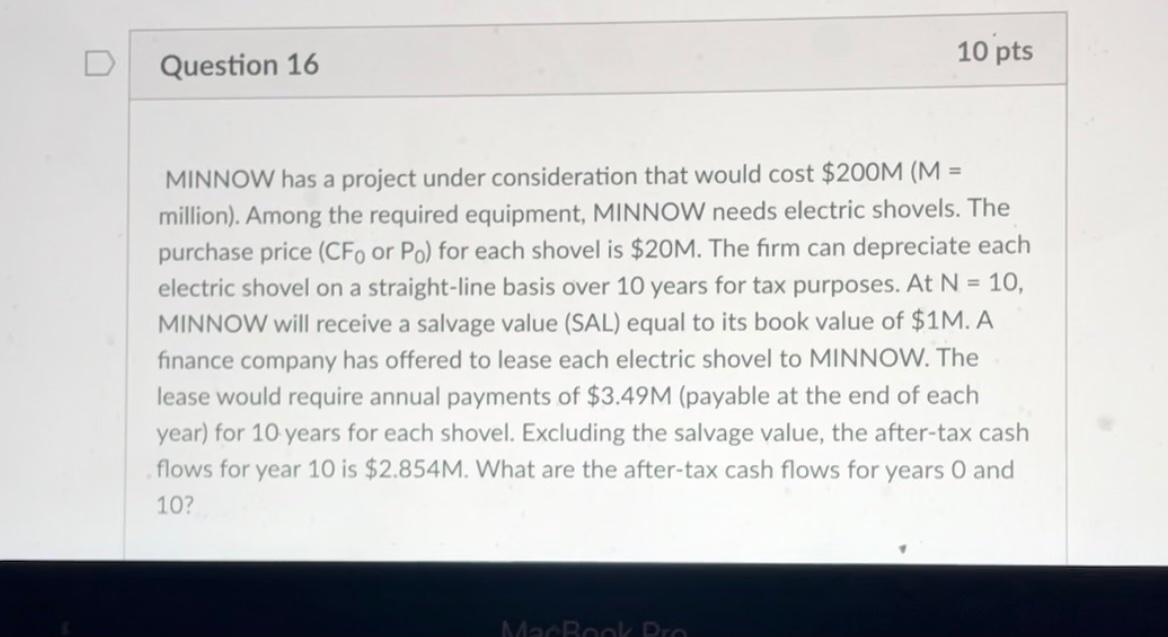

10 pts Question 16 MINNOW has a project under consideration that would cost $200M (M = million). Among the required equipment, MINNOW needs electric shovels. The purchase price (CFo or Po) for each shovel is $20M. The firm can depreciate each electric shovel on a straight-line basis over 10 years for tax purposes. At N = 10, MINNOW will receive a salvage value (SAL) equal to its book value of $1M. A finance company has offered to lease each electric shovel to MINNOW. The lease would require annual payments of $3.49M (payable at the end of each year) for 10 years for each shovel. Excluding the salvage value, the after-tax cash flows for year 10 is $2.854M. What are the after-tax cash flows for years 0 and 10? MR Dro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts