Question: 10 pts Question 4 As with most bonds, consider a bond with a face value of $1,000. The bond's maturity is 15 years, the coupon

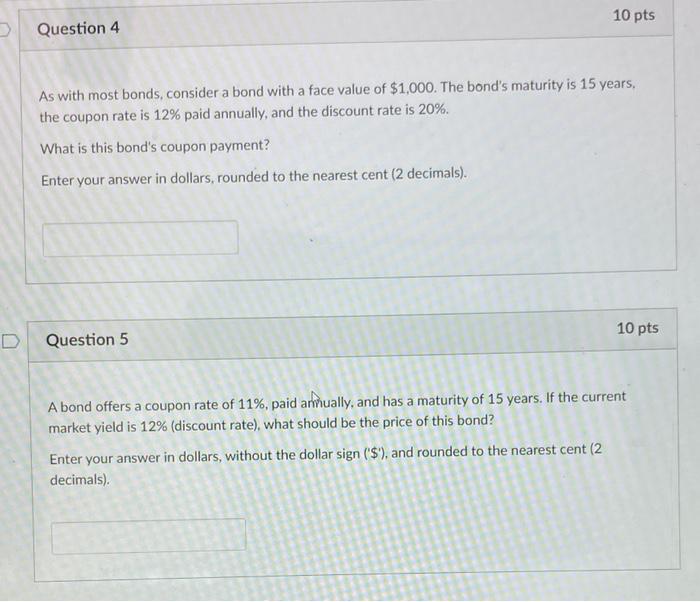

10 pts Question 4 As with most bonds, consider a bond with a face value of $1,000. The bond's maturity is 15 years, the coupon rate is 12% paid annually, and the discount rate is 20%. What is this bond's coupon payment? Enter your answer in dollars, rounded to the nearest cent (2 decimals). 10 pts D Question 5 A bond offers a coupon rate of 11%, paid ammually, and has a maturity of 15 years. If the current market yield is 12% (discount rate), what should be the price of this bond? Enter your answer in dollars, without the dollar sign ('S'), and rounded to the nearest cent (2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts