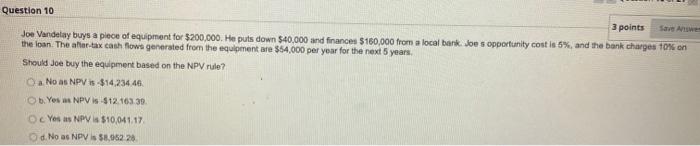

Question: 10 Question 10 3 points Save Answer Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a

Question 10 3 points Save Answer Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. Should Joe buy the equipment based on the NPV rule? Oa. No as NPV is -$14,234.46 Ob. Yes as NPV is $12.163.39. OcYes as NPV is $10,041.17. Od.No as NPV is $8,952 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts