Question: 10. Robert Morrison, a feedlot manager in Clovis, New Mexico, is currently feeding out 1,000 head of steers that will be ready for market

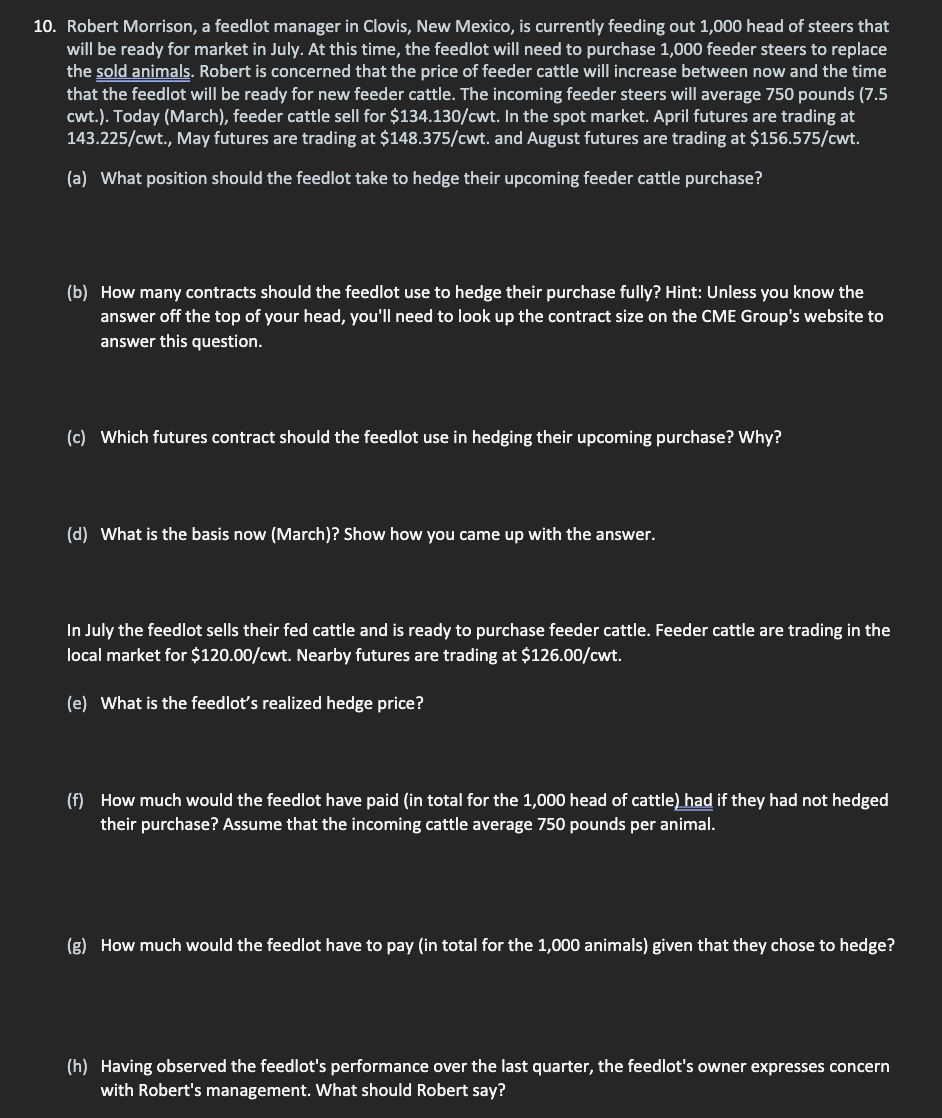

10. Robert Morrison, a feedlot manager in Clovis, New Mexico, is currently feeding out 1,000 head of steers that will be ready for market in July. At this time, the feedlot will need to purchase 1,000 feeder steers to replace the sold animals. Robert is concerned that the price of feeder cattle will increase between now and the time that the feedlot will be ready for new feeder cattle. The incoming feeder steers will average 750 pounds (7.5 cwt.). Today (March), feeder cattle sell for $134.130/cwt. In the spot market. April futures are trading at 143.225/cwt., May futures are trading at $148.375/cwt. and August futures are trading at $156.575/cwt. (a) What position should the feedlot take to hedge their upcoming feeder cattle purchase? (b) How many contracts should the feedlot use to hedge their purchase fully? Hint: Unless you know the answer off the top of your head, you'll need to look up the contract size on the CME Group's website to answer this question. (c) Which futures contract should the feedlot use in hedging their upcoming purchase? Why? (d) What is the basis now (March)? Show how you came up with the answer. In July the feedlot sells their fed cattle and is ready to purchase feeder cattle. Feeder cattle are trading in the local market for $120.00/cwt. Nearby futures are trading at $126.00/cwt. (e) What is the feedlot's realized hedge price? (f) How much would the feedlot have paid (in total for the 1,000 head of cattle) had if they had not hedged their purchase? Assume that the incoming cattle average 750 pounds per animal. (g) How much would the feedlot have to pay (in total for the 1,000 animals) given that they chose to hedge? (h) Having observed the feedlot's performance over the last quarter, the feedlot's owner expresses concern with Robert's management. What should Robert say?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

a The feedlot should take a long position in the futures market to hedge their upcoming feeder cattle purchase By taking a long position they will be ... View full answer

Get step-by-step solutions from verified subject matter experts