Question: 10. Ryan leases office space in a building owned by Dwight for two years. Ryan hires Pam to work at the support desk at an

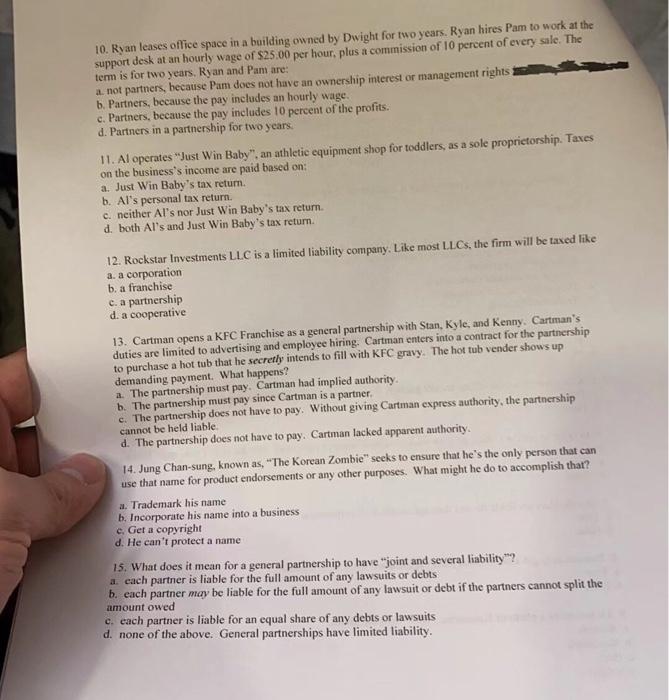

10. Ryan leases office space in a building owned by Dwight for two years. Ryan hires Pam to work at the support desk at an hourly wage of $25.00 per hour, plus a commission of 10 percent of every sale. The term is for two years. Ryan and Pam are: a. not partners, because Pam does not have an ownership interest or management rights b. Partners, because the pay includes an hourly wage. c. Partners, because the pay includes 10 percent of the profits. d. Partners in a partnership for two years. 11. Al operates "Just Win Baby", an athletic equipment shop for toddlers, as a sole proprietorship. Taxes on the business's income are paid based on: a. Just Win Baby's tax return. b. Al's personal tax return. c. neither Al's nor Just Win Baby's tax return d. both Al's and Just Win Baby's tax return. 12. Rockstar Investments LLC is a limited liability company. Like most LLCs, the firm will be taxed like a. a corporation b. a franchise c. a partnership d. a cooperative 13. Cartman opens a KFC Franchise as a general partnership with Stan, Kyle, and Kenny Cartman's duties are limited to advertising and employee hiring. Cartman enters into a contract for the partnership to purchase a hot tub that he secretly intends to fill with KFC gravy. The hot tub vender shows up demanding payment. What happens? a. The partnership must pay Cartman had implied authority b. The partnership must pay since Cartman is a partner, c. The partnership does not have to pay. Without giving Cartman express authority, the partnership cannot be held liable d. The partnership does not have to pay. Cartman lacked apparent authority 14. Jung Chan-sung, known as "The Korean Zombie" seeks to ensure that he's the only person that can use that name for product endorsements or any other purposes. What might he do to accomplish that? a. Trademark his name b. Incorporate his name into a business e. Get a copyright d. He can't protect a name 15. What does it mean for a general partnership to have "joint and several liability? a. each partner is liable for the full amount of any lawsuits or debts b. each partner may be liable for the full amount of any lawsuit or debt if the partners cannot split the amount owed c. each partner is liable for an equal share of any debts or lawsuits d. none of the above. General partnerships have limited liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts