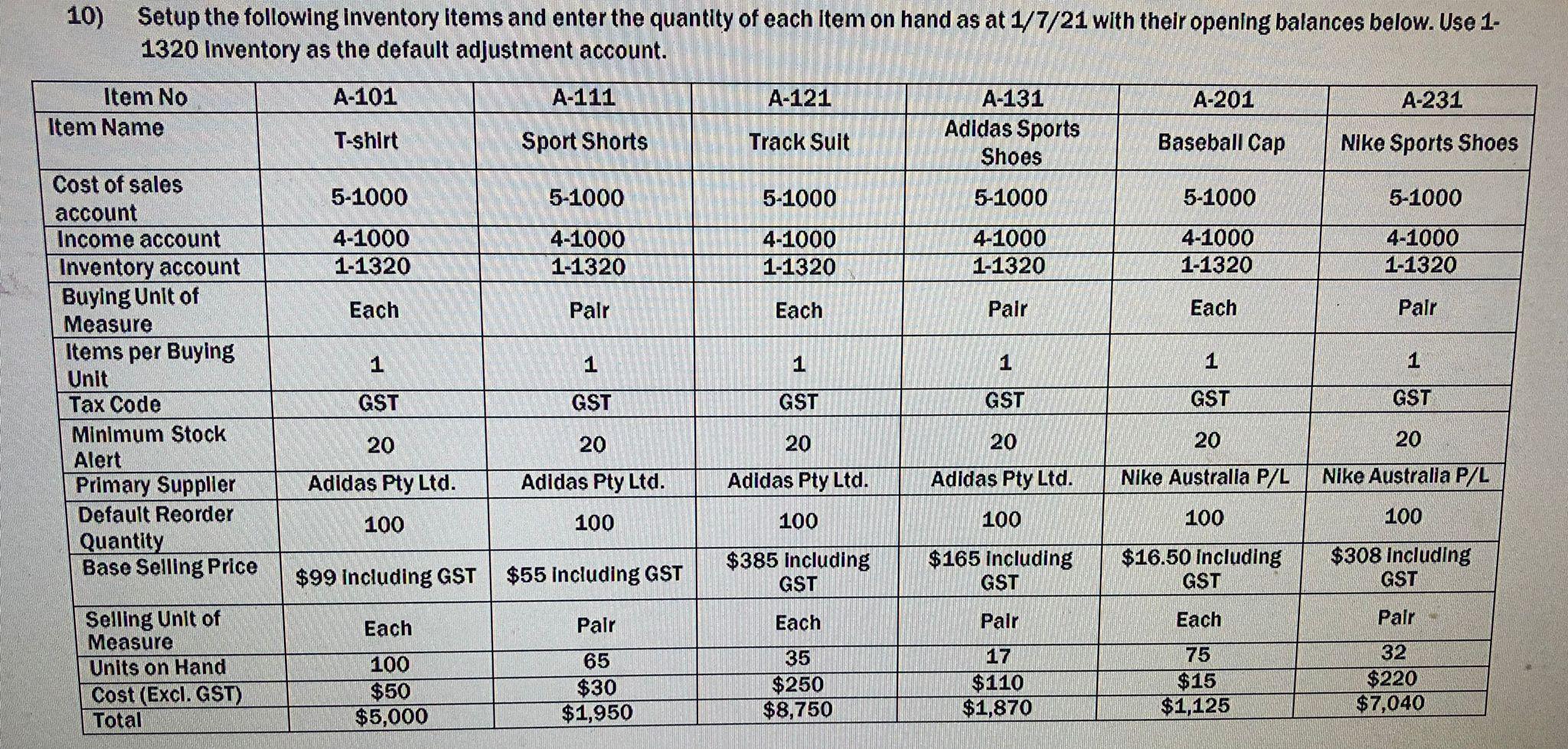

Question: 10) Setup the following inventory items and enter the quantity of each item on hand as at 1/7/21 with their opening balances below. Use

10) Setup the following inventory items and enter the quantity of each item on hand as at 1/7/21 with their opening balances below. Use 1- 1320 Inventory as the default adjustment account. A-101 T-shirt Item No Item Name Cost of sales account Income account Inventory account Buying Unit of Measure Items per Buying Unit Tax Code Minimum Stock Alert Primary Supplier Default Reorder Quantity Base Selling Price Selling Unit of Measure Units on Hand Cost (Excl. GST) Total 5-1000 4-1000 1-1320 Each 1 GST 20 Adidas Pty Ltd. 100 $99 including GST Each 100 $50 $5,000 A-111 Sport Shorts 5-1000 4-1000 1-1320 Pair GST 20 Adidas Pty Ltd. 100 $55 Including GST Pair 65 $30 $1,950 A-121 Track Suit 5-1000 4-1000 1-1320 Each GST 20 Adidas Pty Ltd. 100 $385 including GST Each 35 $250 $8,750 A-131 Adidas Sports Shoes 5-1000 4-1000 1-1320 Pair GST 20 Adidas Pty Ltd. 100 $165 Including GST Pair 17 $110 $1,870 A-201 Baseball Cap 5-1000 4-1000 1-1320 Each GST 20 Nike Australia P/L 100 $16.50 including GST Each 75 $15 $1,125 A-231 Nike Sports Shoes 5-1000 4-1000 1-1320 Pair 1 GST 20 Nike Australia P/L 100 $308 including GST Pair 32 $220 $7,040

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Based on the provided information here is the setup of the inventory items and their quantities on hand as of 1721 Item No A101 Item Name Tshirt Cost ... View full answer

Get step-by-step solutions from verified subject matter experts