Question: 10. Splash Co. maintains a defined benefit pension plan for its employees. At the end of 2008, the pension expense to be recorded by Splash

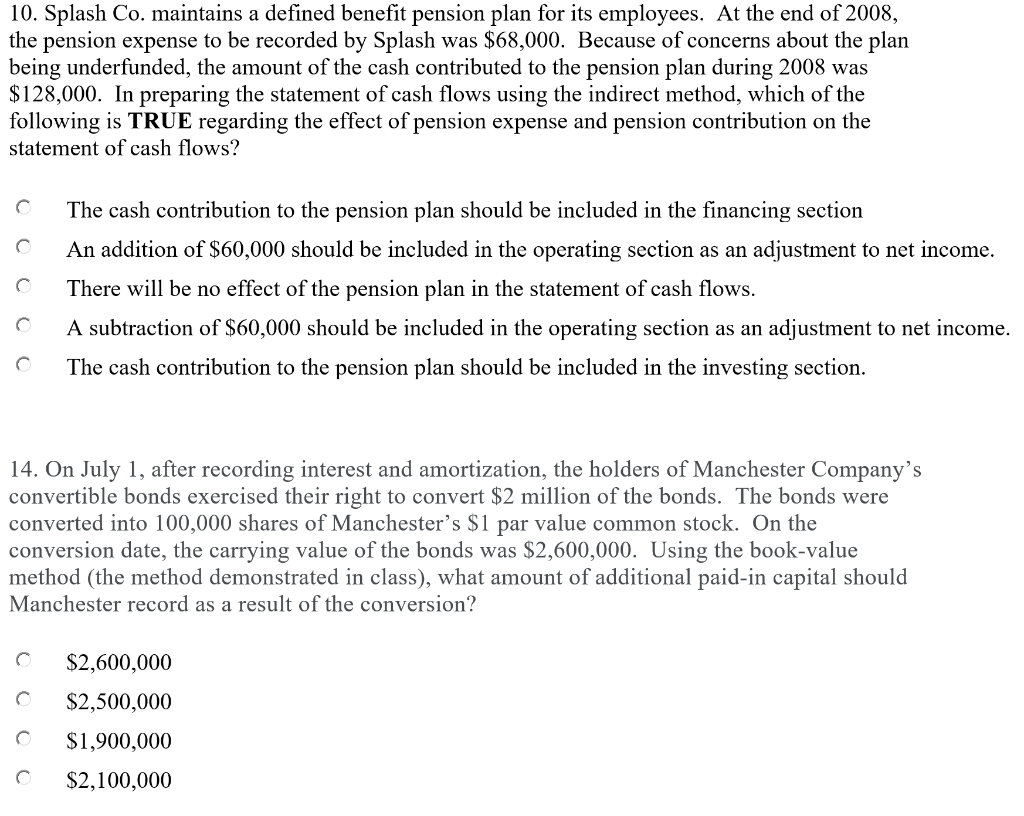

10. Splash Co. maintains a defined benefit pension plan for its employees. At the end of 2008, the pension expense to be recorded by Splash was $68,000. Because of concerns about the plan being underfunded, the amount of the cash contributed to the pension plan during 2008 was $128,000. In preparing the statement of cash flows using the indirect method, which of the following is TRUE regarding the effect of pension expense and pension contribution on the statement of cash flows? O The cash contribution to the pension plan should be included in the financing section An addition of $60,000 should be included in the operating section as an adjustment to net income. There will be no effect of the pension plan in the statement of cash flows. A subtraction of $60,000 should be included in the operating section as an adjustment to net income. The cash contribution to the pension plan should be included in the investing section. 14. On July 1, after recording interest and amortization, the holders of Manchester Company's convertible bonds exercised their right to convert $2 million of the bonds. The bonds were converted into 100,000 shares of Manchester's $1 par value common stock. On the conversion date, the carrying value of the bonds was $2,600,000. Using the book-value method (the method demonstrated in class), what amount of additional paid-in capital should Manchester record as a result of the conversion? 0 C $2,600,000 $2,500,000 $1,900,000 $2,100,000 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts