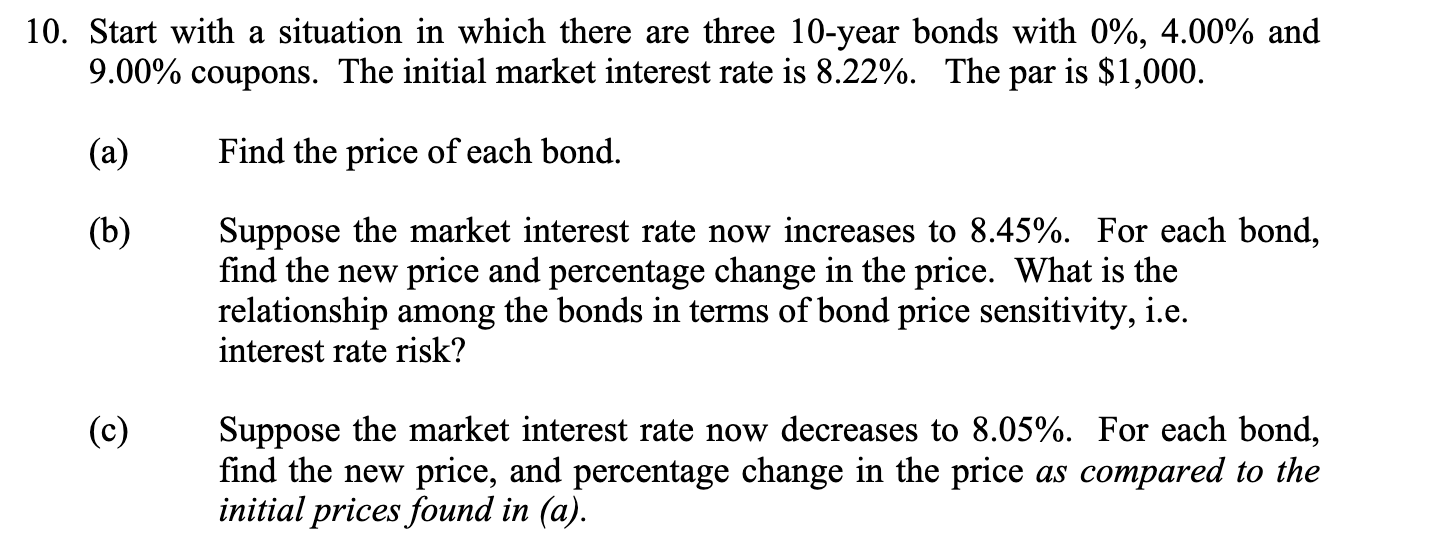

Question: 10. Start with a situation in which there are three 10-year bonds with 0%, 4.00% and 9.00% coupons. The initial market interest rate is 8.22%.

10. Start with a situation in which there are three 10-year bonds with 0%, 4.00% and 9.00% coupons. The initial market interest rate is 8.22%. The par is $1,000. (a) Find the price of each bond. (6) Suppose the market interest rate now increases to 8.45%. For each bond, find the new price and percentage change in the price. What is the relationship among the bonds in terms of bond price sensitivity, i.e. interest rate risk? (c) Suppose the market interest rate now decreases to 8.05%. For each bond, find the new price, and percentage change in the price as compared to the initial prices found in (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts