Question: 10. Sway's Back Store is considering a project which will require the purchase of $1.5 million in new equipment. The equipment will be depreciated following

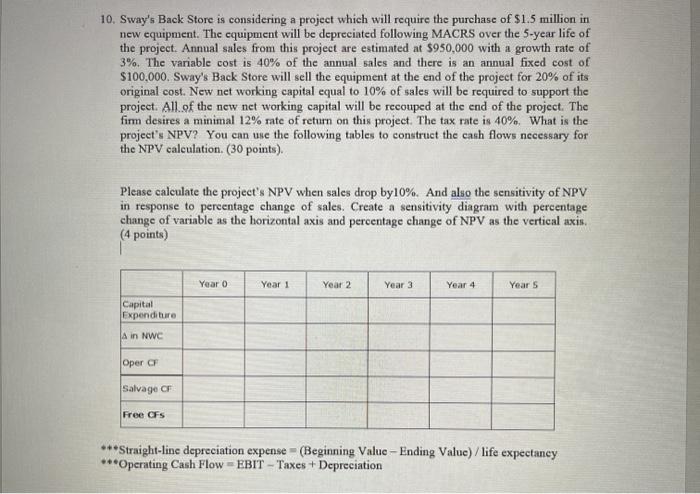

10. Sway's Back Store is considering a project which will require the purchase of $1.5 million in new equipment. The equipment will be depreciated following MACRS Over the 5-year life of the project. Annual sales from this project are estimated at $950,000 with a growth rate of 3%. The variable cost is 40% of the annual sales and there is an annual fixed cost of $100,000. Sway's Back Store will sell the equipment at the end of the project for 20% of its original cost. New net working capital equal to 10% of sales will be required to support the project. All of the new net working capital will be recouped at the end of the project. The fimm desires a minimal 12% rate of return on this project. The tax rate is 40%, What is the project's NPV? You can use the following tables to construct the cash flows necessary for the NPV calculation. (30 points). Please calculate the project's NPV when sales drop by 10%. And also the sensitivity of NPV in response to percentage change of sales. Create a sensitivity diagram with percentage change of variable as the horizontal axis and percentage change of NPV as the vertical axis. (4 points) Year o Year 1 Year 2 Year 3 Year 4 Year 5 Capital Expenditure A in NWC Oper CF Salvage CF Free CFS ***Straight-line depreciation expense - (Beginning Value - Ending Value) / life expectancy ***Operating Cash Flow - EBIT - Taxes + Depreciation 10. Sway's Back Store is considering a project which will require the purchase of $1.5 million in new equipment. The equipment will be depreciated following MACRS Over the 5-year life of the project. Annual sales from this project are estimated at $950,000 with a growth rate of 3%. The variable cost is 40% of the annual sales and there is an annual fixed cost of $100,000. Sway's Back Store will sell the equipment at the end of the project for 20% of its original cost. New net working capital equal to 10% of sales will be required to support the project. All of the new net working capital will be recouped at the end of the project. The fimm desires a minimal 12% rate of return on this project. The tax rate is 40%, What is the project's NPV? You can use the following tables to construct the cash flows necessary for the NPV calculation. (30 points). Please calculate the project's NPV when sales drop by 10%. And also the sensitivity of NPV in response to percentage change of sales. Create a sensitivity diagram with percentage change of variable as the horizontal axis and percentage change of NPV as the vertical axis. (4 points) Year o Year 1 Year 2 Year 3 Year 4 Year 5 Capital Expenditure A in NWC Oper CF Salvage CF Free CFS ***Straight-line depreciation expense - (Beginning Value - Ending Value) / life expectancy ***Operating Cash Flow - EBIT - Taxes + Depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts