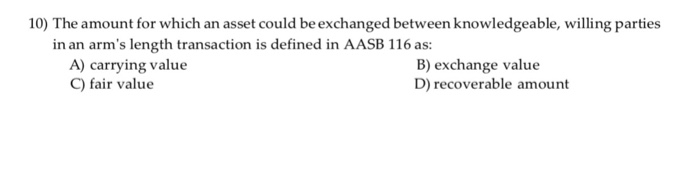

Question: 10) The amount for which an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction is defined in AASB 116 as:

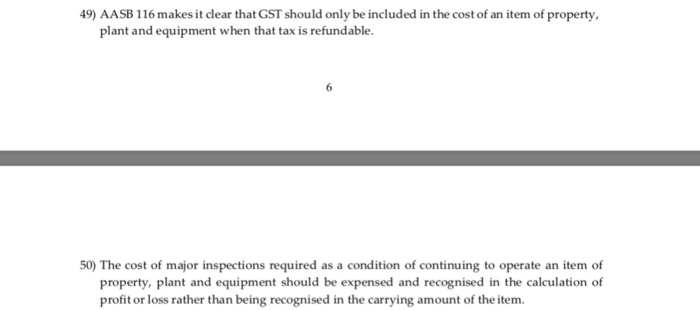

10) The amount for which an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction is defined in AASB 116 as: A) carrying value C) fair value B) exchange value D) recoverable amount TRUE/FALSE, write T if the statement is true andF, if the statement is false. 49) AASB 116 makes it clear that GST should only be included in the cost of an item of property, plant and equipment when that tax is refundable. 50) The cost of major inspections required as a condition of continuing to operate an item of property, plant and equipment should be expensed and recognised in the calculation of profit or loss rather than being recognised in the carrying amount of the item

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts