Question: 10. The NPV and the IRR methods sometimes could result in conflicting ranks between projects. These conflicts will arise when evaluation is being made on:

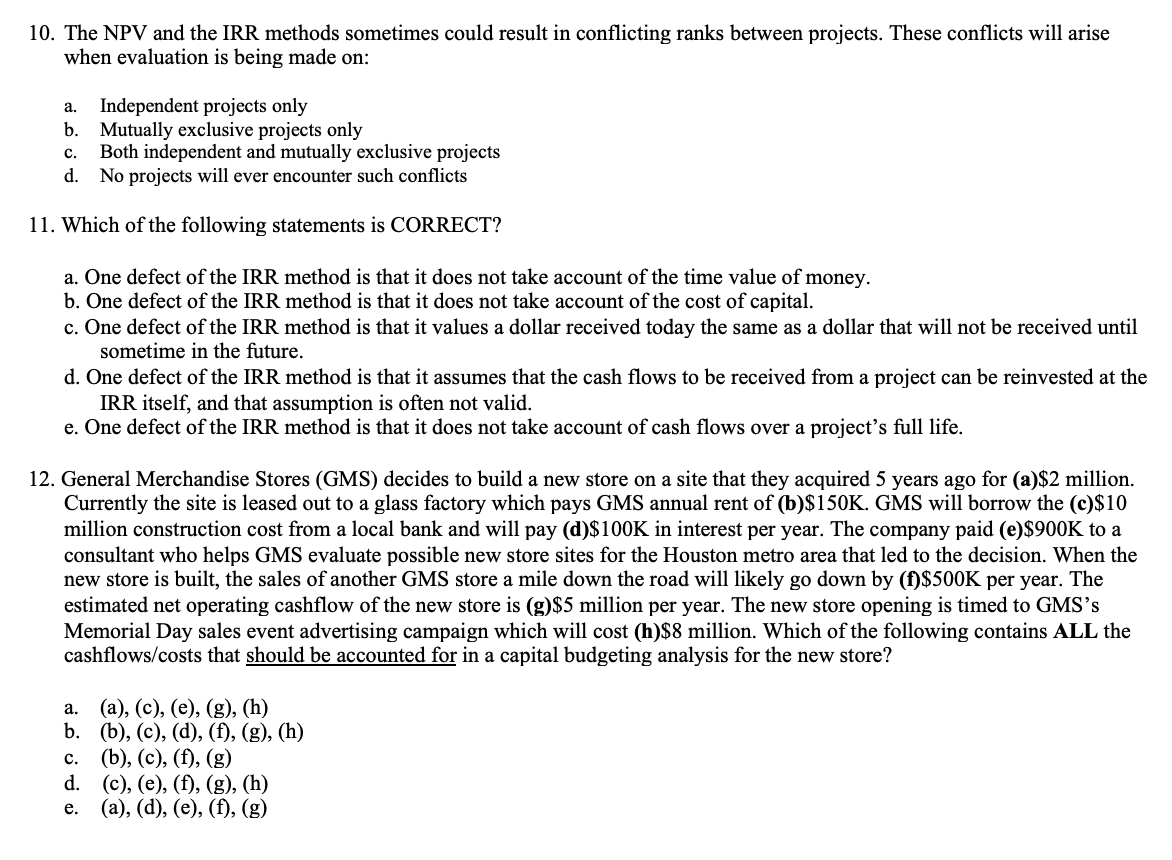

10. The NPV and the IRR methods sometimes could result in conflicting ranks between projects. These conflicts will arise when evaluation is being made on: a. Independent projects only b. Mutually exclusive projects only c. Both independent and mutually exclusive projects d. No projects will ever encounter such conflicts 11. Which of the following statements is CORRECT? a. One defect of the IRR method is that it does not take account of the time value of money. b. One defect of the IRR method is that it does not take account of the cost of capital. c. One defect of the IRR method is that it values a dollar received today the same as a dollar that will not be received until sometime in the future. d. One defect of the IRR method is that it assumes that the cash flows to be received from a project can be reinvested at the IRR itself, and that assumption is often not valid. e. One defect of the IRR method is that it does not take account of cash flows over a project's full life. 12. General Merchandise Stores (GMS) decides to build a new store on a site that they acquired 5 years ago for (a)$2 million. Currently the site is leased out to a glass factory which pays GMS annual rent of (b)$150K. GMS will borrow the (c)$10 million construction cost from a local bank and will pay (d)$100K in interest per year. The company paid (e)$900K to a consultant who helps GMS evaluate possible new store sites for the Houston metro area that led to the decision. When the new store is built, the sales of another GMS store a mile down the road will likely go down by (f)$500K per year. The estimated net operating cashflow of the new store is (g)$5 million per year. The new store opening is timed to GMS's Memorial Day sales event advertising campaign which will cost (h)$8 million. Which of the following contains ALL the cashflows/costs that should be accounted for in a capital budgeting analysis for the new store? a. (a), (c), (e), (g), (h) b. (b), (c), (d), (f), (g), (h) (b), (c), (f), (g) d. (c), (e), (f), (g), (h) (a), (d), (e), (f), (g) c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts