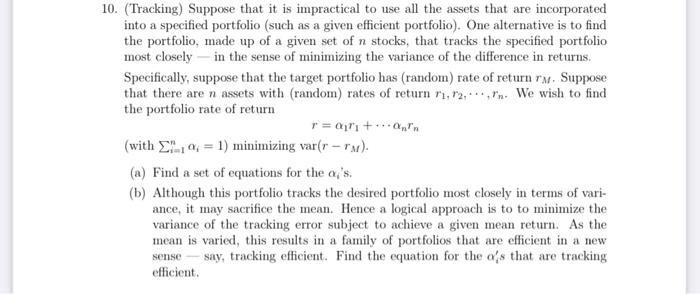

Question: 10. (Tracking) Suppose that it is impractical to use all the assets that are incorporated into a specified portfolio (such as a given efficient portfolio).

10. (Tracking) Suppose that it is impractical to use all the assets that are incorporated into a specified portfolio (such as a given efficient portfolio). One alternative is to find the portfolio, made up of a given set of n stocks, that tracks the specified portfolio most closely in the sense of minimizing the variance of the difference in returns. Specifically, suppose that the target portfolio has (random) rate of return rm. Suppose that there are n assets with (random) rates of return 11, 12,..., in. We wish to find the portfolio rate of return r=0,1 +0, (with E= 1) minimizing var(r-ru). (a) Find a set of equations for the ai's. (b) Although this portfolio tracks the desired portfolio most closely in terms of vari- ance, it may sacrifice the mean. Hence a logical approach is to to minimize the variance of the tracking error subject to achieve a given mean return. As the mean is varied, this results in a family of portfolios that are efficient in a new say, tracking efficient. Find the equation for the a's that are tracking efficient sense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts