Question: (10%) True or False (No need to explain): a. Bonds are considered as financial securities because there are no risks associated with bonds. b. Required

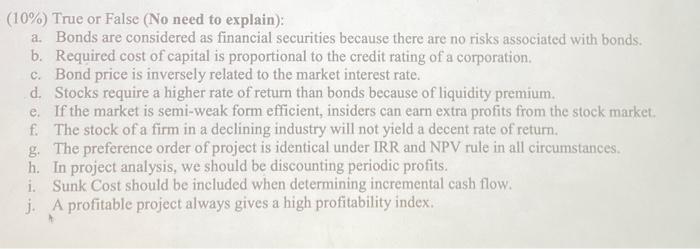

(10\%) True or False (No need to explain): a. Bonds are considered as financial securities because there are no risks associated with bonds. b. Required cost of capital is proportional to the credit rating of a corporation. c. Bond price is inversely related to the market interest rate. d. Stocks require a higher rate of return than bonds because of liquidity premium. e. If the market is semi-weak form efficient, insiders can earn extra profits from the stock market. f. The stock of a firm in a declining industry will not yield a decent rate of return. g. The preference order of project is identical under IRR and NPV rule in all circumstances. h. In project analysis, we should be discounting periodic profits. i. Sunk Cost shoutd be included when determining incremental cash flow. j. A profitable project always gives a high profitability index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts