Question: #10 Use this information to answer the question below: - The spot rate (current exchange rate) is 22.00/5 - The annual risk-free borrowing/investing rate in

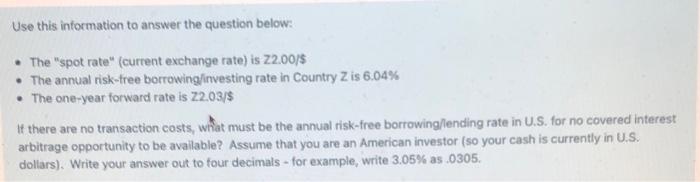

Use this information to answer the question below: - The "spot rate" (current exchange rate) is 22.00/5 - The annual risk-free borrowing/investing rate in Country Z is 6.04% - The one-year forward rate is 22.03/\$ If there are no transaction costs, what must be the annual risk-free borrowing/lending rate in U.S. for no covered interest arbitrage opportunity to be avallable? Assume that you are an American investor (so your cash is currently in U.S. dollars). Write your answer out to four decimals - for example, write 3.05% as .0305

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts