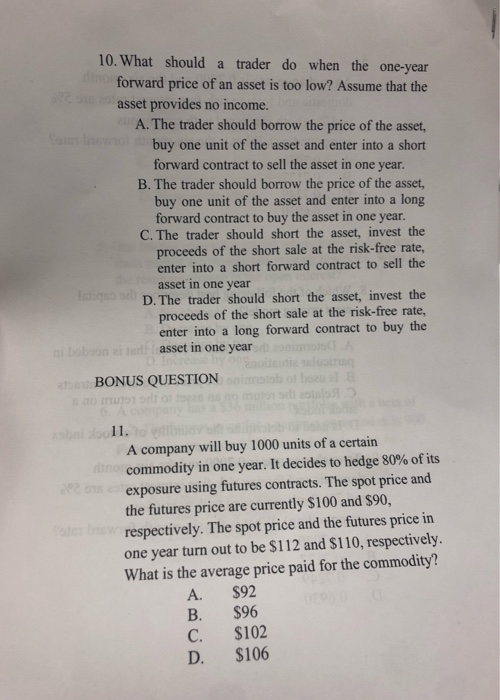

Question: 10. What should a trader do when the one-year forward price of an asset is too low? Assume that the asset provides no income. A.

10. What should a trader do when the one-year forward price of an asset is too low? Assume that the asset provides no income. A. The trader should borrow the price of the asset, buy one unit of the asset and enter into a short forward contract to sell the asset in one year. B. The trader should borrow the price of the asset, buy one unit of the asset and enter into a long forward contract to buy the asset in one year. C. The trader should short the asset, invest the proceeds of the short sale at the risk-free rate, enter into a short forward contract to sell the asset in one year D. The trader should short the asset, invest the proceeds of the short sale at the risk-free rate, enter into a long forward contract to buy the asset in one year BONUS QUESTION miesto oboz A company will buy 1000 units of a certain commodity in one year. It decides to hedge 80% of its exposure using futures contracts. The spot price and the futures price are currently $100 and $90, respectively. The spot price and the futures price in one year turn out to be $112 and $110, respectively. What is the average price paid for the commodity? A. $92 B. $96 $102 D. $106

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts