Question: 10. Which allocation base (students, Classu, UIT 11. Jamil Inc. makes steel chairs and recycled wood chairs. Both chairs are made by hand. Jamil Inc

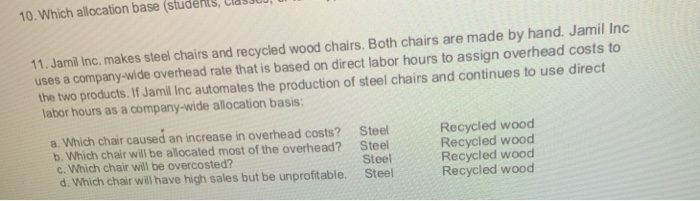

10. Which allocation base (students, Classu, UIT 11. Jamil Inc. makes steel chairs and recycled wood chairs. Both chairs are made by hand. Jamil Inc uses a company-wide overhead rate that is based on direct labor hours to assign overhead costs to the two products. If Jamil Inc automates the production of steel chairs and continues to use direct labor hours as a company-wide allocation basis: a. Which chair caused an increase in overhead costs? b. Which chair will be allocated most of the overhead? c. Which chair will be overcosted? d. Which chair will have high sales but be unprofitable. Steel Steel Steel Steel Recycled wood Recycled wood Recycled wood Recycled wood 10. Which allocation base (students, Classu, UIT 11. Jamil Inc. makes steel chairs and recycled wood chairs. Both chairs are made by hand. Jamil Inc uses a company-wide overhead rate that is based on direct labor hours to assign overhead costs to the two products. If Jamil Inc automates the production of steel chairs and continues to use direct labor hours as a company-wide allocation basis: a. Which chair caused an increase in overhead costs? b. Which chair will be allocated most of the overhead? c. Which chair will be overcosted? d. Which chair will have high sales but be unprofitable. Steel Steel Steel Steel Recycled wood Recycled wood Recycled wood Recycled wood

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts