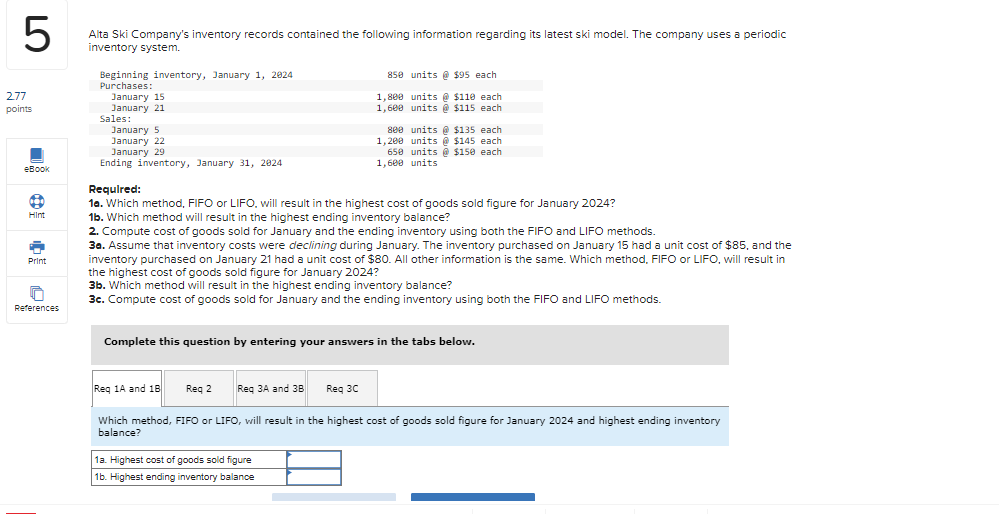

Question: 10. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 ? 1b. Which method will result

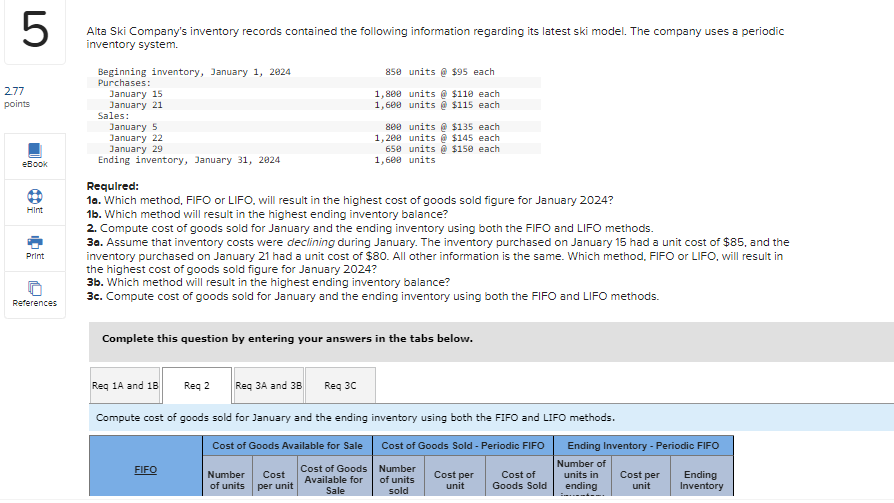

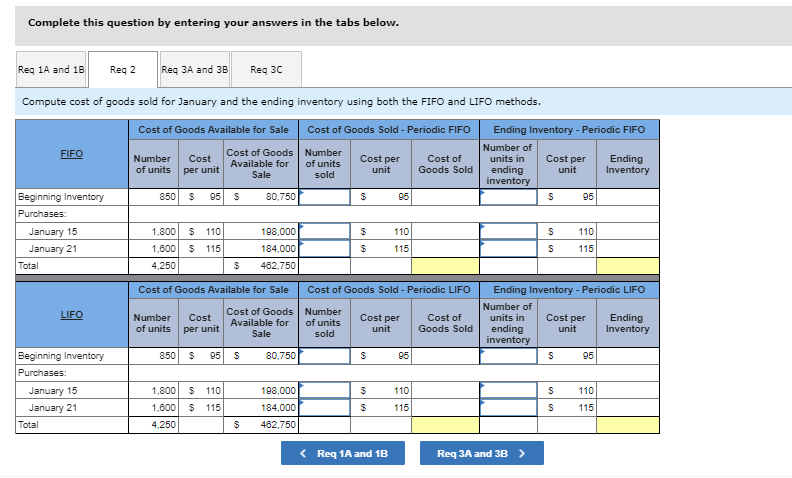

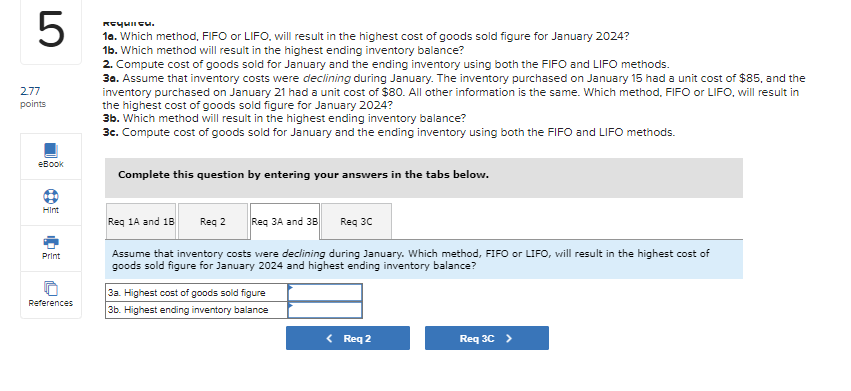

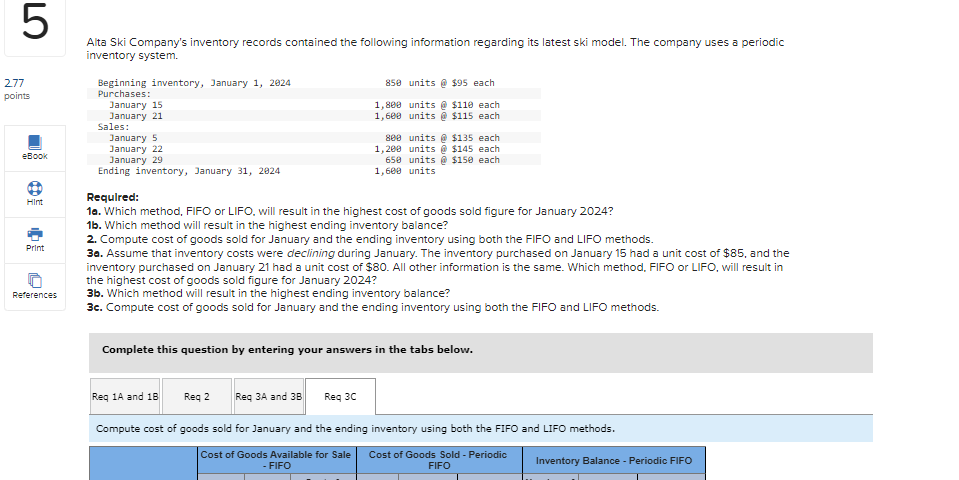

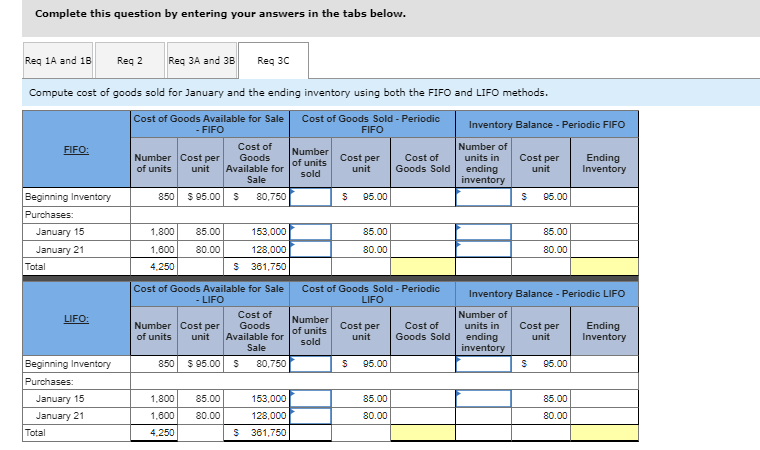

10. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 ? 1b. Which method will result in the highest ending inventory balance? 2. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. 30. Assume that inventory costs were declining during January. The inventory purchased on January 15 had a unit cost of $85, and the inventory purchased on January 21 had a unit cost of $80. All other information is the same. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024? 3b. Which method will result in the highest ending inventory balance? 3c. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. Complete this question by entering your answers in the tabs below. Assume that inventory costs were declining during January. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 and highest ending inventory balance? Complete this question by entering your answers in the tabs below. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. Alta Ski Company's inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Requlred: 10. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 ? 1b. Which method will result in the highest ending inventory balance? 2. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. 30. Assume that inventory costs were declining during January. The inventory purchased on January 15 had a unit cost of $85, and the inventory purchased on January 21 had a unit cost of $80. All other information is the same. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 ? 3b. Which method will result in the highest ending inventory balance? 3c. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. Complete this question by entering your answers in the tabs below. Alta Ski Company's inventory records contained the following information regarding its latest ski model. The company uses a periodic nventory system. Requlred: la. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 ? lb. Which method will result in the highest ending inventory balance? 2. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. 30. Assume that inventory costs were declining during January. The inventory purchased on January 15 had a unit cost of $85, and the nventory purchased on January 21 had a unit cost of $80. All other information is the same. Which method, FIFO or LIFO, will result in he highest cost of goods sold figure for January 2024 ? 3b. Which method will result in the highest ending inventory balance? 3c. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. Complete this question by entering your answers in the tabs below. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. Alta Ski Company's inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Requlred: 10. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024? 1b. Which method will result in the highest ending inventory balance? 2. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. 30. Assume that inventory costs were declining during January. The inventory purchased on January 15 had a unit cost of $85, and the inventory purchased on January 21 had a unit cost of $80. All other information is the same. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024? 3b. Which method will result in the highest ending inventory balance? 3c. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods. Complete this question by entering your answers in the tabs below. Which method, FIFO or LIFO, will result in the highest cost of goods sold figure for January 2024 and highest ending inventory balance? Complete this question by entering your answers in the tabs below. Compute cost of goods sold for January and the ending inventory using both the FIFO and LIFO methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts