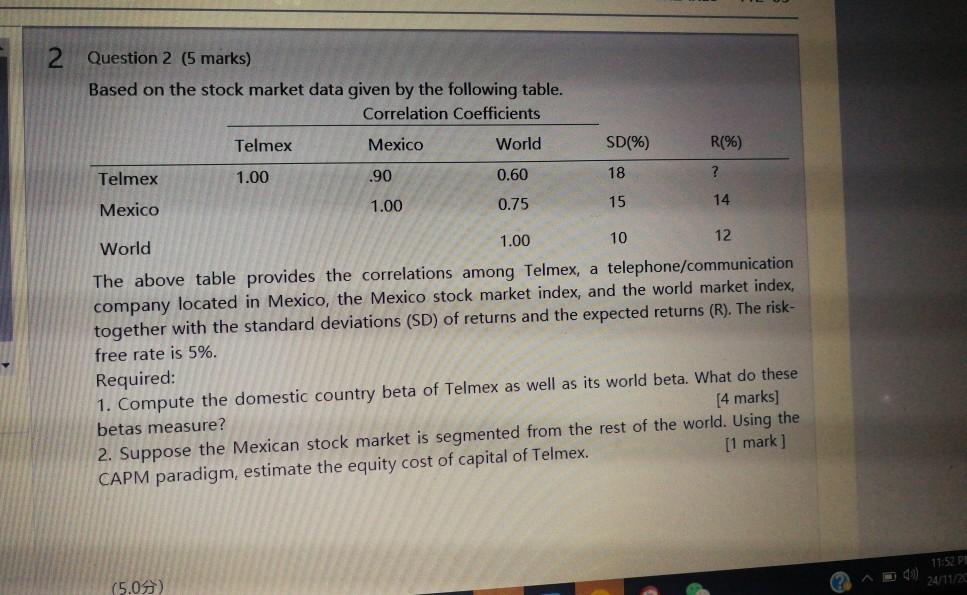

Question: 1.00 2 Question 2 (5 marks) Based on the stock market data given by the following table. Correlation coefficients Telmex Mexico World SD(%) R(%) Telmex

1.00 2 Question 2 (5 marks) Based on the stock market data given by the following table. Correlation coefficients Telmex Mexico World SD(%) R(%) Telmex .90 0.60 18 ? Mexico 1.00 0.75 15 14 World 1.00 10 12 The above table provides the correlations among Telmex, a telephone/communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations (SD) of returns and the expected returns (R). The risk- free rate is 5%. Required: 1. Compute the domestic country beta of Telmex as well as its world beta. What do these [4 marks] betas measure? 2. Suppose the Mexican stock market is segmented from the rest of the world. Using the [1 mark] CAPM paradigm, estimate the equity cost of capital of Telmex. 11:52 24/11/22 (5.00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts