Question: 100% Normal text Arial - 12 + BIU A 2 3 4 5 6.The market price of a security is $40. Its expected rate of

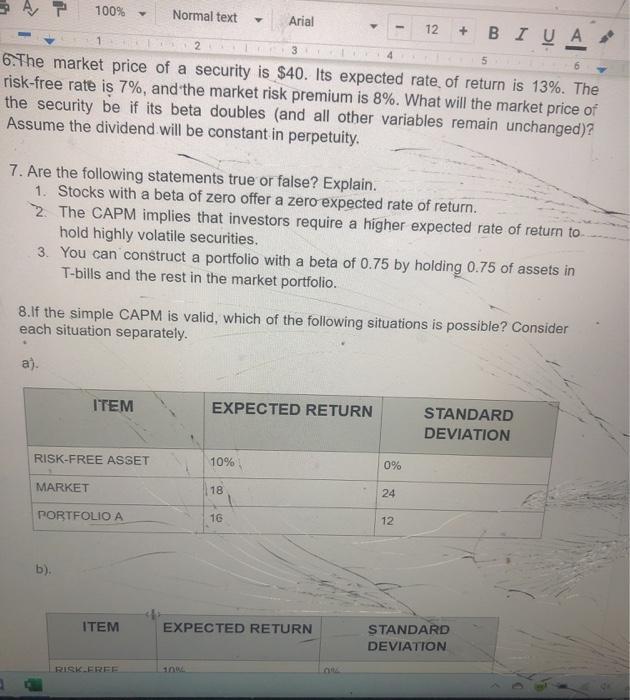

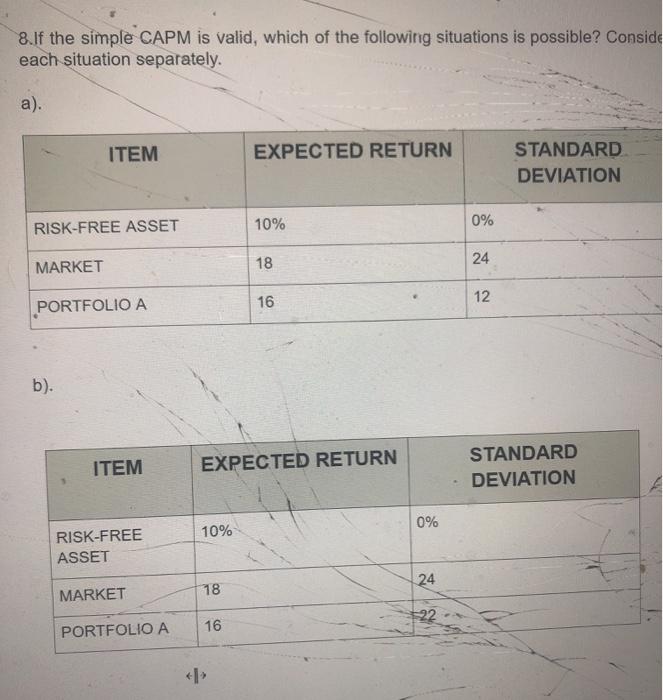

100% Normal text Arial - 12 + BIU A 2 3 4 5 6.The market price of a security is $40. Its expected rate of return is 13%. The risk-free rate is 7%, and the market risk premium is 8%. What will the market price of the security be if its beta doubles (and all other variables remain unchanged)? Assume the dividend will be constant in perpetuity. 7. Are the following statements true or false? Explain. 1. Stocks with a beta of zero offer a zero expected rate of return. 2. The CAPM implies that investors require a higher expected rate of return to hold highly volatile securities. 3. You can construct a portfolio with a beta of 0.75 by holding 0.75 of assets in T-bills and the rest in the market portfolio. 8.If the simple CAPM is valid, which of the following situations is possible? Consider each situation separately. a). ITEM EXPECTED RETURN STANDARD DEVIATION RISK-FREE ASSET 10% 0% MARKET 18 24 PORTFOLIO A 16 12 b). ITEM EXPECTED RETURN STANDARD DEVIATION RISKERER 8.If the simple CAPM is valid, which of the following situations is possible? Conside each situation separately. a). ITEM EXPECTED RETURN STANDARD DEVIATION 10% 0% RISK-FREE ASSET MARKET 18 24 PORTFOLIO A 16 12 b). ITEM EXPECTED RETURN STANDARD DEVIATION 0% 10% RISK-FREE ASSET 24 MARKET 18 22 PORTFOLIO A 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts