Question: 10.00 points Both a call and a put currently are traded on stock XYZ; both have strike prices of $46 and maturities of six months.

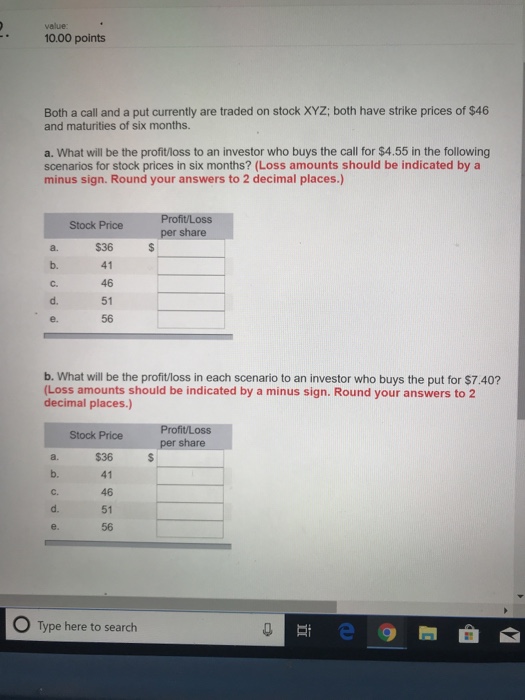

10.00 points Both a call and a put currently are traded on stock XYZ; both have strike prices of $46 and maturities of six months. a. What will be the profit/loss to an investor who buys the call for $4.55 in the following scenarios for stock prices in six months? (Loss amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Stock Price Profit/Loss per share b. C. d. $36 41 46 51 56 b. What will be the profitloss in each scenario to an investor who buys the put for $7.40? Loss amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Stock Price Profi/Loss per share $36 41 46 b. d. 51 56 O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts