Question: 10.00 points Problem 26-8 Hedging with Calls (LO2) A large dental lab plans to purchase 1,000 ounces of gold in 1 month. Gold currently sells

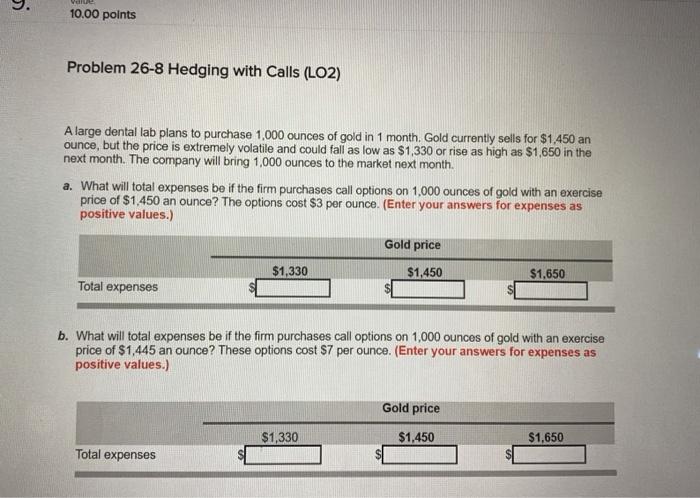

10.00 points Problem 26-8 Hedging with Calls (LO2) A large dental lab plans to purchase 1,000 ounces of gold in 1 month. Gold currently sells for $1.450 an ounce, but the price is extremely volatile and could fall as low as $1,330 or rise as high as $1,650 in the next month. The company will bring 1,000 ounces to the market next month. a. What will total expenses be if the firm purchases call options on 1,000 ounces of gold with an exercise price of $1,450 an ounce? The options cost $3 per ounce. (Enter your answers for expenses as positive values.) Gold price $1,330 $1,450 $1.650 Total expenses b. What will total expenses be if the firm purchases call options on 1,000 ounces of gold with an exercise price of $1,445 an ounce? These options cost $7 per ounce. (Enter your answers for expenses as positive values.) Gold price $1,330 $1,450 $1,650 Total expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts