Question: 1,000 words please will rate Case Analysis: Equity Financing Continuing in your role as the Chief Financial Officer (CFO) of Anycorp Inc., you are interested

1,000 words please will rate

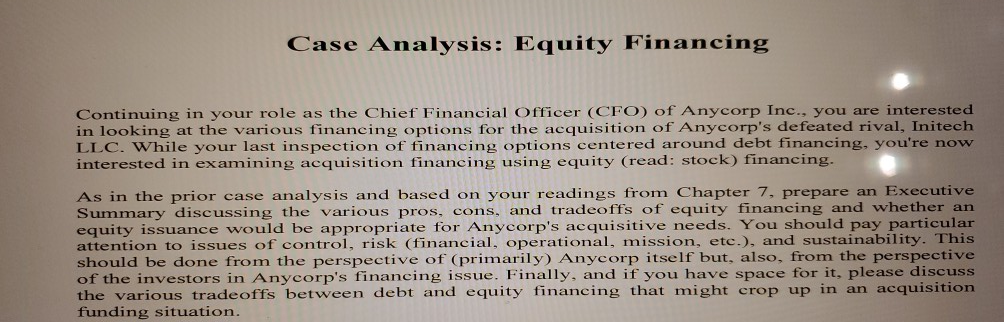

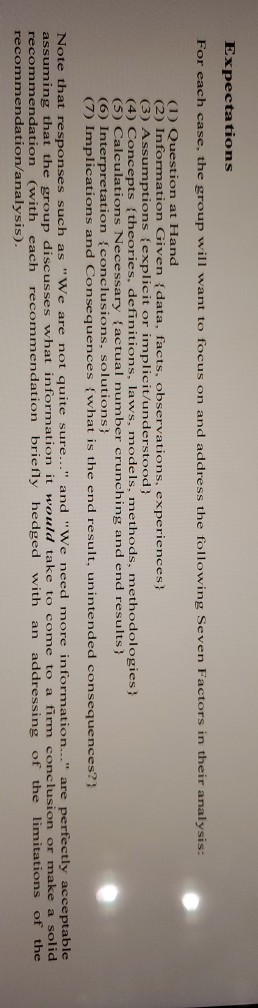

Case Analysis: Equity Financing Continuing in your role as the Chief Financial Officer (CFO) of Anycorp Inc., you are interested in looking at the various financing options for the acquisition of Anycorp's defeated rival, Initech LLC. While your last inspection of financing options centered around debt financing, you're now interested in examining acquisition financing using equity (read: stock) financing. As in the prior case analysis and based on your readings from Chapter 7, prepare an Executive Summary discussing the various pros, cons, and tradeoffs of equity financing and whether an equity issuance would be appropriate for Anycorp's acquisitive needs. You should pay particular attention to issues of control, risk (financial, operational, mission, etc.), and sustainability. This should be done from the perspective of (primarily) Anycorp itself but, also, from the perspective of the investors in Anycorp's financing issue. Finally, and if you have space for it, please discuss the various tradeoffs between debt and equity financing that might crop up in an acquisition funding situation. Expectations For each case, the group will want to focus on and address the following Seven Factors in their analysis: (1) Question at Hand (2) Information Given {data, facts, observations, experiences; (3) Assumptions {explicit or implicit/understood (4) Concepts theories, definitions, laws, models, methods, methodologies (5) Calculations Necessary {actual number crunching and end results) (6) Interpretation conclusions, solutions) (7) Implications and Consequences {what is the end result, unintended consequences? Note that responses such as "We are not quite sure..." and "We need more information..." are perfectly acceptable assuming that the group discusses what information it would take to come to a firm conclusion or make a solid recommendation (with each recommendation briefly hedged with an addressing of the limitations of the recommendation/analysis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts