Question: 1.000.000, 7. Consistent with U.S GAAP, we classify cash flows as operating, investing, or financing activities under IFRS. Ooo However, with regard to interest and

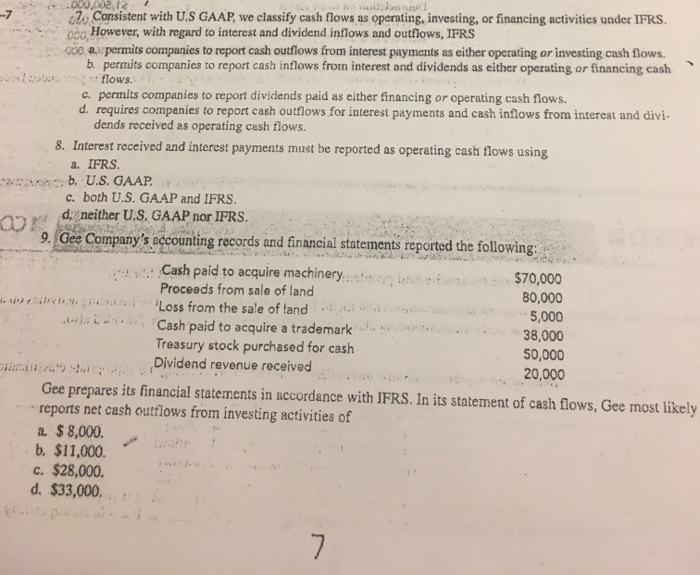

1.000.000, 7. Consistent with U.S GAAP, we classify cash flows as operating, investing, or financing activities under IFRS. Ooo However, with regard to interest and dividend inflows and outflows, IFRS 000 a. permits companies to report cash outflows from interest payments as either operating or investing cash flows. b. permits companies to report cash inflows from interest and dividends as either operating or financing cash flows. c. permits companies to report dividends paid as either financing or operating cash flows. d. requires companies to report cash outflows for interest payments and cash inflows from interest and divi- dends received as operating cash flows. 8. Interest received and interest payments must be reported as operating cash flows using a. IFRS. b. U.S. GAAP. c. both U.S. GAAP and IFRS. d, neither U.S. GAAP nor IFRS. 9. Gee Company's accounting records and financial statements reported the following: Cash paid to acquire machinery:.. $70,000 Proceeds from sale of land 80,000 We Loss from the sale of land. Loss from the sale of land ' Cash paid to acquire a trademark " . . . 38.000 Treasury stock purchased for cash 50,000 Dividend revenue received . 20,000 20.000 Gee prepares its financial statements in accordance with IFRS. In its statement of cash flows, Gee most likely reports net cash outflows from investing activities of a. $ 8,000. b. $11,000 C. $28,000. d. $33,000 3,0UU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts