Question: (10-1) NPV EASY PROBLEMS 1-7 A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and

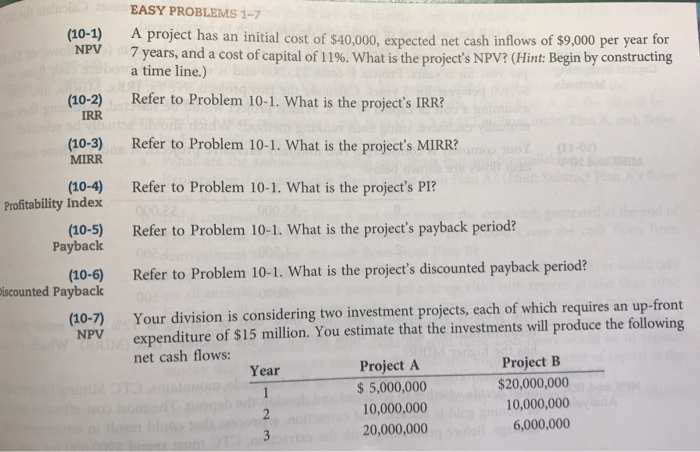

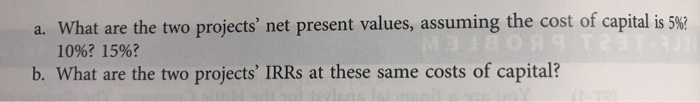

(10-1) NPV EASY PROBLEMS 1-7 A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%. What is the project's NPV? (Hint: Begin by constructing a time line.) Refer to Problem 10-1. What is the project's IRR? Refer to Problem 10-1. What is the project's MIRR? (10-2) IRR (10-3) MIRR (10-4) Profitability Index (10-5) Payback Refer to Problem 10-1. What is the project's PI? Refer to Problem 10-1. What is the project's payback period? Refer to Problem 10-1. What is the project's discounted payback period? (10-6) Discounted Payback (10-7) NPV Your division is considering two investment projects, each of which requires an up-front expenditure of $15 million. You estimate that the investments will produce the following net cash flows: Year Project A Project B $ 5,000,000 $20,000,000 10,000,000 10,000,000 20,000,000 6,000,000 a. What are the two projects' net present values, assuming the cost of capital is 5%? 10%? 15%? b. What are the two projects' IRRs at these same costs of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts