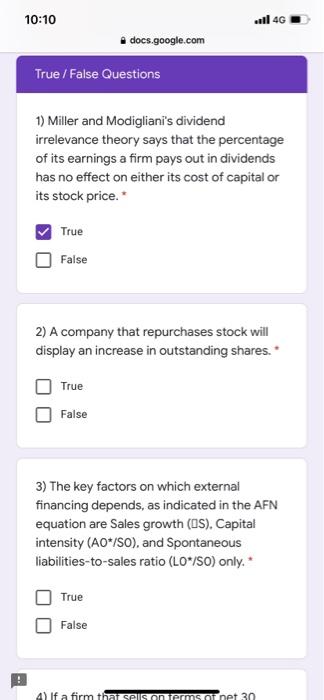

Question: 10:10 l 4G docs.google.com True / False Questions 1) Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings a firm pays

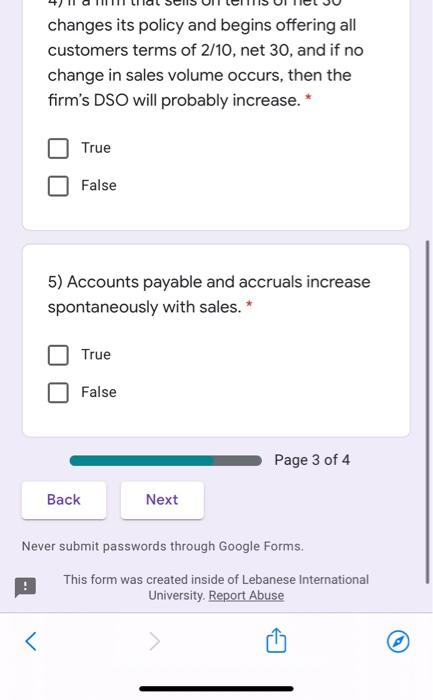

10:10 l 4G docs.google.com True / False Questions 1) Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings a firm pays out in dividends has no effect on either its cost of capital or its stock price. True False 2) A company that repurchases stock will display an increase in outstanding shares. True False 3) The key factors on which external financing depends, as indicated in the AFN equation are Sales growth (OS). Capital intensity (A0*/S0), and Spontaneous liabilities-to-sales ratio (LO*/50) only. True False A) If a firm that seis on terms of net 30 changes its policy and begins offering all customers terms of 2/10, net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase.* True False 5) Accounts payable and accruals increase spontaneously with sales.* True False Page 3 of 4 Back Next Never submit passwords through Google Forms. This form was created inside of Lebanese International University. Report Abuse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts