Question: 10-12 Time Let Time Limit: 2:45:00 Question 10 (6 points) Listen Rhode Warriors is considering purchasing a new distribution center today for $800,000 that it

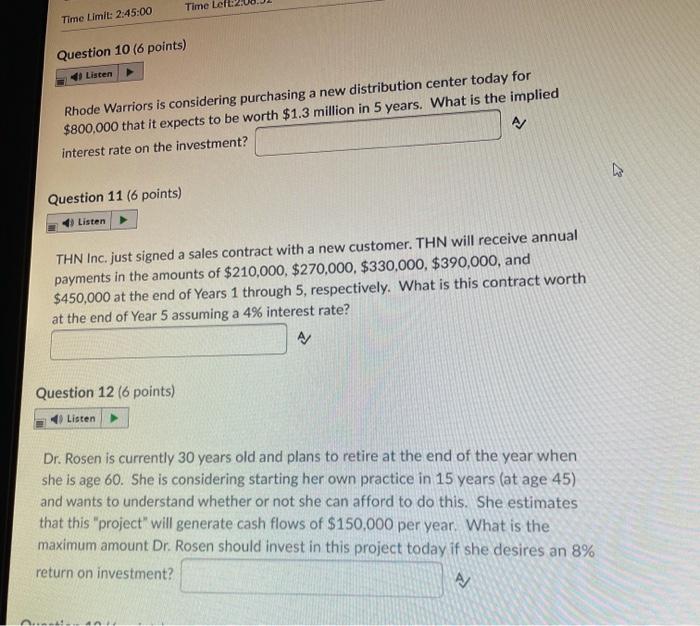

Time Let Time Limit: 2:45:00 Question 10 (6 points) Listen Rhode Warriors is considering purchasing a new distribution center today for $800,000 that it expects to be worth $1.3 million in 5 years. What is the implied interest rate on the investment? A Question 11 (6 points) Listen THN Inc. just signed a sales contract with a new customer. THN will receive annual payments in the amounts of $210,000, $270,000. $330,000, $390,000, and $450,000 at the end of Years 1 through 5, respectively. What is this contract worth at the end of Year 5 assuming a 4% interest rate? A/ Question 12 (6 points) Listen Dr. Rosen is currently 30 years old and plans to retire at the end of the year when she is age 60. She is considering starting her own practice in 15 years (at age 45) and wants to understand whether or not she can afford to do this. She estimates that this project will generate cash flows of $150,000 per year. What is the maximum amount Dr. Rosen should invest in this project today if she desires an 8% return on investment? .. 4A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts