Question: 102 Interest Expense on Note Payable ment of note plus interest. (Round to the nearest cent.) Payroll Expenses 102 deductions, S13,160; and salaries subject to

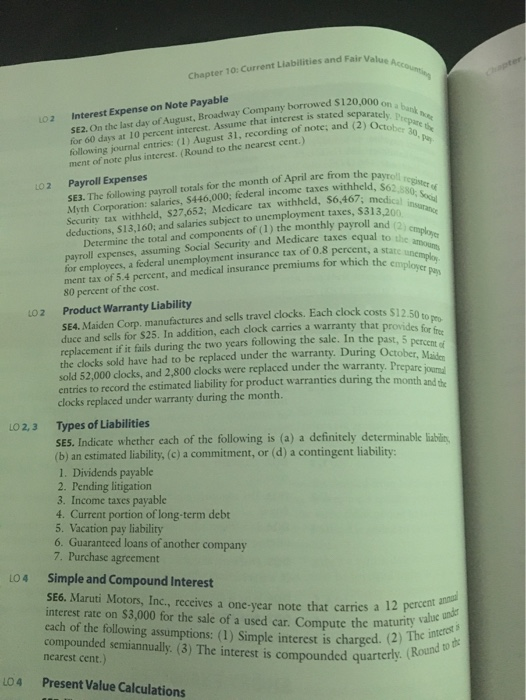

102 Interest Expense on Note Payable ment of note plus interest. (Round to the nearest cent.) Payroll Expenses 102 deductions, S13,160; and salaries subject to unemployment taxes, 8313,200 80 percent of the cost. Product Warranty Liability Chapter 10: Current Liabilities and Fair Value Acco SE2. On the last day of August, Broadway Company borrowed $120,000 on a bank following journal entries: (1) August 31, recording of note, and (2) October 10. for 60 days at 10 percent interest. Assume that interest is stated separately upate Myth Corporation: salaries, 5446,000; federal income taxes withheld, 56250 S SE3. The following payroll totals for the month of April are from the payrol Security tax withheld, 527,652; Medicare tax withheld, $6,467; medical Determine the total and components of (1) the monthly payroll and 2 cmployer payroll expenses, assuming Social Security and Medicare taxes equal to the moms for employees, a federal unemployment insurance tax of 0.8 percent, a state unemplo ment tax of 5.4 percent, and medical insurance premiums for which the employees SE4. Maiden Corp. manufactures and sells travel clocks. Each clock costs $12.50 to duce and sells for $25. In addition, each clock carries a warranty that provides for ft SE6. Maruti Motors, Inc., receives a one-year note that carries a 12 percent interest rate on $3,000 for the sale of a used car. Compute the maturity value under each of the following assumptions: (1) Simple interest is charged. (2) The interests compounded semiannually. (3) The interest is compounded quarterly. (Round to be LOZ replacement if it fails during the two years following the sale. In the past, 5 percenta sold 52,000 clocks, and 2,800 clocks were replaced under the warranty. Prepare jaune entries to record the estimated liability for product warranties during the month and the clocks replaced under warranty during the month. LO 2, 3 Types of Liabilities SES. Indicate whether each of the following is (a) a definitely determinable liabilir, (b) an estimated liability, (c) a commitment, or (d) a contingent liability: 1. Dividends payable 2. Pending litigation 3. Income taxes payable 4. Current portion of long-term debt 5. Vacation pay liability 6. Guaranteed loans of another company 7. Purchase agreement LO 4 Simple and Compound Interest nearest cent. L04 Present Value Calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts