Question: 10.25 Completing an ANOVA table. How are returns on common stocks in overseas markets related to returns in U.S. markets? Consider measuring U.S. returns by

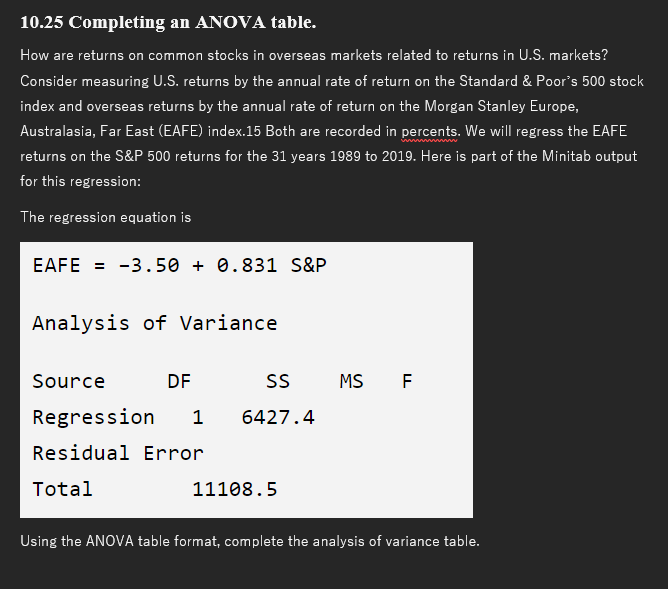

10.25 Completing an ANOVA table. How are returns on common stocks in overseas markets related to returns in U.S. markets? Consider measuring U.S. returns by the annual rate of return on the Standard & Poor's 500 stock index and overseas returns by the annual rate of return on the Morgan Stanley Europe, Australasia, Far East (EAFE) index.15 Both are recorded in percents. We will regress the EAFE returns on the S&P 500 returns for the 31 years 1989 to 2019. Here is part of the Minitab output for this regression: The regression equation is EAFE = -3.50 + 0.831 S&P Analysis of Variance Source DF SS MS F Regression 1 6427.4 Residual Error Total 11108.5 Using the ANOVA table format, complete the analysis of variance table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts