Question: 1065 PARTNERSHIP RETURN AbleBaker Book Store Date Business Started 01/01/2017 334 West Main Street Martinez, GA 30907 This example Form 1065 is for the Able

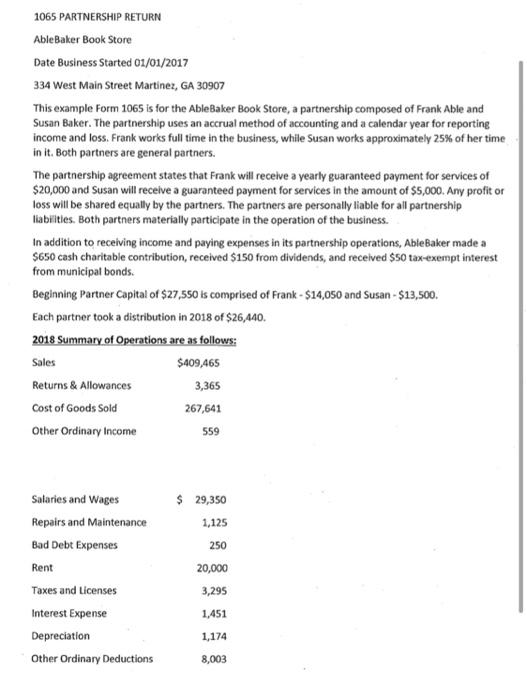

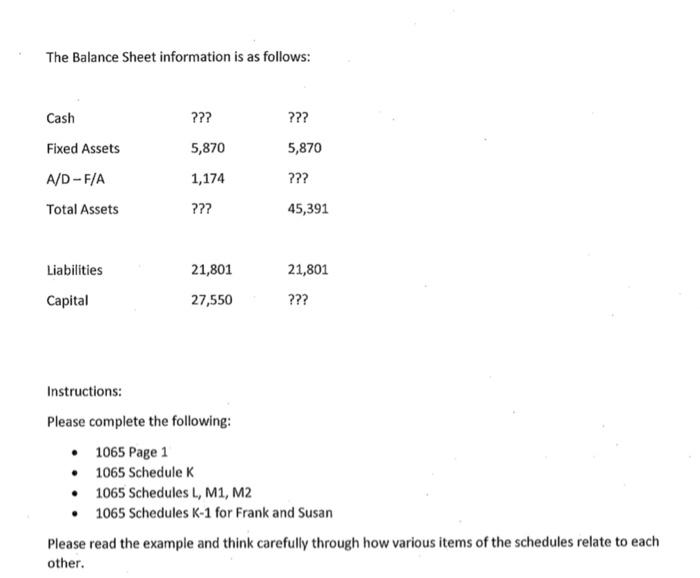

1065 PARTNERSHIP RETURN AbleBaker Book Store Date Business Started 01/01/2017 334 West Main Street Martinez, GA 30907 This example Form 1065 is for the Able Baker Book Store, a partnership composed of Frank Able and Susan Baker. The partnership uses an accrual method of accounting and a calendar year for reporting income and loss. Frank works full time in the business, while Susan works approximately 25% of her time in it. Both partners are general partners. The partnership agreement states that Frank will receive a yearly guaranteed payment for services of $20,000 and Susan will receive a guaranteed payment for services in the amount of $5,000. Any profit or loss will be shared equally by the partners. The partners are personally liable for all partnership liabilities. Both partners materially participate in the operation of the business. In addition to receiving income and paying expenses in its partnership operations, Able Baker made a $650 cash charitable contribution, received $150 from dividends, and received $50 tax-exempt interest from municipal bonds. Beginning Partner Capital of $27,550 is comprised of Frank - $14,050 and Susan - $13,500. Each partner took a distribution in 2018 of $26,440. 2018 Summary of Operations are as follows: Sales $409,465 Returns & Allowances 3,365 Cost of Goods Sold 267,641 Other Ordinary Income 559 $ 29,350 1,125 250 Sataries and Wages Repairs and Maintenance Bad Debt Expenses Rent Taxes and licenses Interest Expense Depreciation Other Ordinary Deductions 20,000 3,295 1,451 1,174 8,003 The Balance Sheet information is as follows: Cash ??? 5,870 Fixed Assets A/D-F/A Total Assets ??? 5,870 1,174 ??? ??? 45,391 Liabilities Capital 21,801 27,550 21,801 ??? Instructions: Please complete the following: 1065 Page 1 1065 Schedule K 1065 Schedules L, M1, M2 1065 Schedules K-1 for Frank and Susan Please read the example and think carefully through how various items of the schedules relate to each other. 1065 PARTNERSHIP RETURN AbleBaker Book Store Date Business Started 01/01/2017 334 West Main Street Martinez, GA 30907 This example Form 1065 is for the Able Baker Book Store, a partnership composed of Frank Able and Susan Baker. The partnership uses an accrual method of accounting and a calendar year for reporting income and loss. Frank works full time in the business, while Susan works approximately 25% of her time in it. Both partners are general partners. The partnership agreement states that Frank will receive a yearly guaranteed payment for services of $20,000 and Susan will receive a guaranteed payment for services in the amount of $5,000. Any profit or loss will be shared equally by the partners. The partners are personally liable for all partnership liabilities. Both partners materially participate in the operation of the business. In addition to receiving income and paying expenses in its partnership operations, Able Baker made a $650 cash charitable contribution, received $150 from dividends, and received $50 tax-exempt interest from municipal bonds. Beginning Partner Capital of $27,550 is comprised of Frank - $14,050 and Susan - $13,500. Each partner took a distribution in 2018 of $26,440. 2018 Summary of Operations are as follows: Sales $409,465 Returns & Allowances 3,365 Cost of Goods Sold 267,641 Other Ordinary Income 559 $ 29,350 1,125 250 Sataries and Wages Repairs and Maintenance Bad Debt Expenses Rent Taxes and licenses Interest Expense Depreciation Other Ordinary Deductions 20,000 3,295 1,451 1,174 8,003 The Balance Sheet information is as follows: Cash ??? 5,870 Fixed Assets A/D-F/A Total Assets ??? 5,870 1,174 ??? ??? 45,391 Liabilities Capital 21,801 27,550 21,801 ??? Instructions: Please complete the following: 1065 Page 1 1065 Schedule K 1065 Schedules L, M1, M2 1065 Schedules K-1 for Frank and Susan Please read the example and think carefully through how various items of the schedules relate to each other